Complete Guide To Vietnam Company Registry

- 08/03/2023

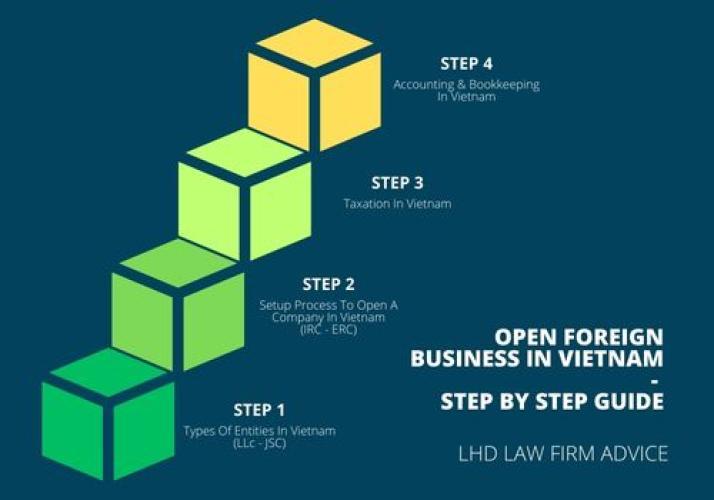

Set up company in Vietnam - Step by step guide

CONTENT

CONTENT

CONTENT

CONTENT

With LHD Law Firm comprehensive legal understanding of the international business environment in Vietnam, we can supply clients with fundamentally beneficial legal advice in areas of foreign investments. Whether it is:

Setting up a 100% foreign invested or joint venture enterprise, joint stock company Registration and de-registration of branches, businesses and representative offices Finding partnerships, settling negotiations Review and drafting of legal documents...

Please find hereunder some key terms and conditions for our Company Incorporation Services:

A. Pre-licensing services

(i). Consulting: Attending various meetings with client to explain and confirm the main principles for setting up the Company; Preparing a list of legal documents required for the appraisal of the Company. Based on the information provided by client, we will review and incorporate these documents into the application file;

(ii). Drafting documents: Drafting the application form for the Investment Certificate; Drafting the Charter of the Company; Drafting an outline of the Feasibility Study for the establishment of the Company based on the client's business intention which shall include descriptions of the activities and operational scope of the Company, the invested capital, the scale of services, and the efficiency of the Company. B. Incorporating: Reviewing and assembling all required documents to be included in the application file for the Investment Certificate; Representing client to submit the application files for the Investment Certificate; and Acting as client's attorney to follow up with the competent authorities regarding the establishment of the company and obtaining the Investment Certificate. C. Post-licensing services:Upon the issuance of Investment Certificate of the Company, we shall assist the newly established Company in complying with post licensing requirements: Registering and obtaining the Company’s seal; Preparing necessary dossiers and representing the Company to submit the application for the Company’s Tax Code and Customs Code with the competent tax authorities. D. Additional services:Together with the legal services as aforementioned, we would be happy to assist client various legal issues related to business, including: Advisory services on opening bank account; Personal income tax registration, declaration and finalization for expatriate and local employees; Advisory services on employee recruiting and labor issues; Drafting and registering statutory labor collective agreement and internal labor regulations. Given our experience in working with various international and local companies, we believe that our assistance to client's business in Vietnam would be of great assistance to the establishment of the Company.

B. STEP TO STEP REGISTER A NEW BUSINESS IN VIETNAM

Step 1: Choosing a business structure to register company in Vietnam

In order to do business legally in Vietnam, you should register your company in Vietnam with the appropriate authorities. Before doing this, you first need to decide which legal form is suitable for your business. When trying to choose the most suitable legal form for your business, you need to consider the following:

What would be your personal financial liability if your business fails to do well? Your personal financial liability as owner of the business would be different according to the legal form you choose. To learn about your personal financial obligations, read your legal form options according to Enterprise Law below.

- What kind of tax obligations you would have depending on the legal form of your business?

- What kind of reporting obligations you would have under each legal form?

- How will your potential to raise capital from formal financial institutions (banks, credit funds, leasing companies, etc.) differ according to the legal form of your business?

- What will be the management structure of your business based on the legal form you choose?

Under the Enterprise Law 2005 of Vietnam, your options you have in respect of the legal form of your business are the following:

+ Private enterprise

+ Limited liability company

+ Shareholding company

Step 2: Reservation of company name in Vietnam

When registering to establish a foreign-invested business, investors must also register its names, including:

- The Vietnamese name

- The foreign language name

- The abbreviated name

In which the Vietnamese name is a requisite for licensing procedures.

Once licensed, investors may choose to promote their business with one of the registered names, whether it is the Vietnamese name, the foreign name, or the abbreviated.

The Vietnamese name

The Vietnamese name contains two components:

Type of enterprise + Proper name

Type of enterprise

Normally, types of enterprise are abbreviated in Vietnamese:

- Limited liability company (Công ty trách nhiệm hữu hạn): ‘Công ty TNHH’

- Joint stock company (Công ty cổ phần): ‘Công ty CP’

- Partnership (Công ty hợp danh): ‘Công ty HD’

- Private enterprise (Doanh nghiệp tư nhân): ‘DNTN’

Examples:

Công ty trách nhiệm hữu hạn Nước giải khát Coca-Cola Việt Nam (Coca-Cola Beverages Vietnam Limited Liability Company)

⇒ Công ty TNHH Nước giải khát Coca-Cola Việt Nam

Công ty Cổ phần Hưng Thịnh (Hung Thinh Joint Stock Company)

⇒ Công ty CP Hưng Thịnh

Proper name

The proper name is written using the letters in the Vietnamese alphabet, letters F, J, Z, W, numerals, and symbols.

Symbols permitted for use: “&”, “.”, “+”, “-”, “_”

Example: Công ty TNHH Thời Trang T&T (T&T Fashion Company Limited)

Vietnamese name transliterated from the foreign language name may also be used.

Example: English name: Gossen Salvador Limited Company

Vietnamese name: Công ty TNHH Gôxen Xanvađo.

The business registration office has the right to refuse or accept the name proposed to be registered by an enterprise.

Article 38 of the 2014 Law on Enterprises

Foreign language and abbreviated names

The name of an enterprise in a foreign language is the name translated from Vietnamese into any of the foreign languages in the Latin lettering system.

Example: Công ty TNHH Aeon Việt Nam

⇒ English name: Aeon Vietnam Company Limited.

When translated, the proper name may remain unchanged or may be translated into a foreign language with a corresponding meaning.

Example: Công ty TNHH Rồng Việt

⇒ English name: Viet Dragon Limited Company; or

⇒ English name: Rong Viet Limited Company.

The abbreviated name of an enterprise may be an abbreviation of its Vietnamese name or its foreign language name.

Example: ‘Hung Vuong JSC’ is abbreviated from the English name ‘Hung Vuong Joint Stock Company’.

Step 3: Preparation of relevant documents to register company in Vietnam

Business registration in Vietnam is only valid when you submit LHD Law Firm the following documents as the company’s founder:

- Proof of financial capacity per business scale

- Legal representatives’ current residency

- Business and professional profile

- Applicant’s identity card or passport

- Articles of Association

- Power of attorney

- Enterprise registration certificate and investment registration certificate (for foreign companies)

- List of shareholders

- Business plan and production plan

Step 4: Application of Investment Registration Certificate (IRC)

The Investment Registration Certificate (IRC) is a required certificate in the business registration process for foreigners who want to open a company in Vietnam.

According to Article 3 of the Investment Law 2020, an Investment Registration Certificate (IRC) is a paper or digital certificate recording the information of an investor about an investment project. The IRC is issued by the Department of Planning and Investment.

The Investment Registration Certificate includes the following main and basic contents:

· Name, code number and title of the project

· Name, address, nationality and passport number of the investor(s) (investment registrant(s))

· Names, content and objectives of the investment project

· Scale, schedule and implementation time of the project

· Location of the project

· Business lines;

· General rights and obligations of the investors

· Total investment capital of the project

The legal time limit for granting IRC for investment projects in the Investment Law 2020 is 15 working days. The IRC will be granted to projects that fully satisfy the following conditions:

· Investment projects that do not have business lines or industries banned from investment and business

· Having a location for the implementation of the investment project (registered address)

· Fitting with the Government planning on both the National and the local level

· Satisfying the conditions on minimum investment per m2 (if applicable)

· Satisfying market access conditions for foreign investors.

In addition, IRC applicants will also be required to provide additional documents depending on the business line and investment activities if necessary. Likewise, IRC approval may take longer than expected if the project requires approval from higher-level Vietnam Government agencies.

Step 5: Register company in Vietnam to obtain Business Registration Certificate

Besides IRC, foreign investors are required to apply for the Enterprise Registration Certificate (ERC), also known as the Business Registration Certificate (BRC).

For foreign investors, before establishing an economic organization in Vietnam, they must have an investment project and carry out procedures for issuance of an Investment Registration Certificate. Then carry out the procedures to apply for a Enterprise Registration Certificate to establish an economic organization or implement a project. This is a license issued to companies operating under the Enterprise Law 2020 and the Investment Law 2020 in Vietnam.

An ERC includes the following main and basic contents:

· The name and the tax code of the enterprise

· Address of the head office of the enterprise

· Charter capital for companies, investment capital for private enterprises

· Business lines (sometimes)

· Full name, contact address, nationality, number of legal papers of the legal representative(s) as well as basic information about the members/shareholders of the company

· Signature and seal of the issuer of the ERC

Step 6: Application of Foreign Investment License (FIC)

The establishment of an FIC in Vietnam requires an Investment Certificate from the licensing authority.

Depending upon the location of the company, the licensing authority may be the Department of Planning and Investment (for companies located outside industrial or export processing zones) or the provincial Industrial and Export Processing Zones Management Authority (for companies located in industrial or export processing zones).

The law requires that within 15 working days from submission of the application dossier, the relevant authority has to issue an Investment Certificate for Foreign Investor.

For granting the Investment Certificate, the relevant licensing authorities shall evaluate the legitimacy and the feasibility of such investment projects to determine whether to grant the Investment Certificate. The criteria are as follows:

- Legitimacy within the legal framework – including Vietnam’s WTO Commitments, Vietnam Investment Law, Vietnam Enterprise Law, and the regulations applicable to specific industries and to the master economic development plan of the city or province in which the FIC registers its head office.

- Financial ability of the investor – the investment capital necessary for the investment project, and the facilities and human resources to implement it.

Step 7: Register for Tax Registration

From March 2022, foreign suppliers without any presence in Vietnam may pay tax for their turnover generated in the country via the portal http://etaxvn.gdt.gov.vn. Specifically, a foreign supplier (taxpayer) may use a single email address throughout the process of tax registration, declaration and payment as follows:

· Step 1: The taxpayer prepares a tax registration dossier in accordance with law.

· Step 2: The taxpayer logs in the Portal of the General Department of Taxation (GDT) for creation and sending of the tax registration dossier.

· Step 3: The GDT’s Portal sends a verification code to the taxpayer’s email address.

· Step 4: The taxpayer uses the verification code to send the tax registration dossier to the GDT’s Portal.

· Step 5: The GDT’s portal sends a notice of receipt of the e-tax registration dossier to the taxpayer.

· Step 6: After receiving the tax registration dossier, the tax office examines its components and contents:

- For the first-time tax registration:

+ In case the dossier is complete and valid, the tax office will accept it and send the GDT’s notice of grant of a tax identification number and information on the account for logging in the GDT’s Portal to the taxpayer’s email address. The taxpayer will use the transaction code stated in the notice to search information and status of the first-time tax registration dossier it/he/she has submitted.

+ In case the dossier is incomplete or invalid, the tax office will send a notice of invalid contents to the taxpayer’s email address. The taxpayer will use the transaction code stated in the notice to search the unsuccessfully submitted dossier, modify the dossier and then submit it again.

- For changes in tax registration information:

The tax office will examine the taxpayer’s dossier of registration of change in tax registration information, update valid information and send a notice of valid information and invalid information to the taxpayer’s email address. The taxpayer will use the transaction code stated in the notice to search the submitted dossier, then modify and submit it again.

- Time limit for dossier processing:

+ In case the dossier is complete, the tax office will notify the acceptance of the dossier and process the dossier within three working days from the date of dossier receipt.

+ In case the dossier is incomplete, the tax office will notify such to the taxpayer within two working days from the date of dossier receipt.

- No charge and fee will be imposed.

- Dossier components:

+ For the first-time tax registration: A tax registration declaration, made according to Form No. 01/NCCNN.

+ For change in tax registration information: A declaration of modified or supplemented tax registration information, made according to Form No. 01-1/NCCNN.

Step 8: Creation of company seal

In Vietnam, an official company seal or chop is used for legally authorizing documentation. A seal gives legal validity to any documents or papers issued by companies, organizations or agencies. Any paper or document showing an official act of a company that contains only a signature of its general director is still considered insufficient. Indeed, the use of the seal of any organization or company in Vietnam is essential.

Under the Government Decree No.58/2001/ND-CP and Decree No.31/2009/ND-CP, issued in August 2001 and April 2009, respectively, each company or organization is permitted to use only one seal. In case the company or organization needs another seal with content identical to the first one, such second seal must have a specific mark that is distinctive from the original one. Ink for all seals must be red. The Ministry of Public Security has the right to grant seal engraving permits, uniformly prescribe specimens of all seal types, and manage seal engraving activities.

Subsequently, Vietnam’s National Assembly promulgated Law No. 68/2014/QH13 on enterprises, which came into force on July 1, 2015. From that day, companies have the right to freely decide the form, content, and amount of their seals, provided that the contents of seals display the company’s name and ID number.

As per the latest amendment to the Law on Enterprises, which will take effect on January 2021, businesses will no longer need to notify the Business Registration Authority (BRA) of the company seal sample. Additional businesses are allowed to decide on the type, number, form, and content of seals without notifying the BRA.

Step 9: Corporate bank account opening

As a non-resident in Vietnam, a foreigner is welcome and has the freedom to open a bank account in the country. This is highly recommended for quick and convenient transactions, especially if you are planning to reside in Vietnam for more than 6 months or directly invest to the Vietnamese market.

Thanks to our long-time partnership with several banking institutions in Vietnam, LHD Law Firm can assist you in opening a bank account, whether you are a foreign individual residing in Vietnam or an investor establishing a company in Vietnam and wishing to open a corporate bank account.

Opening a bank account with LHD Law Firm can help you to choose the most suitable bank for your needs and to make the process much faster and easier. Get in touch with us should you require further information on opening a bank account in Vietnam.

0 comment