Ha Noi Company Formation - Legal Advantages

- 24/03/2023

CONTENT

CONTENT

CONTENT

CONTENT

A Comprehensive Guide to Setting Up a Foreign Company in Hanoi, Vietnam

Introduction:

Are you an expat looking to establish a foreign-owned company in Hanoi, Vietnam? Navigating the legal landscape can be challenging, especially when it comes to understanding the requirements, procedures, and regulations. This guide aims to provide you with a comprehensive overview of the process, detailing the steps you need to take and the legal considerations you should be aware of when setting up a new foreign company in Hanoi.

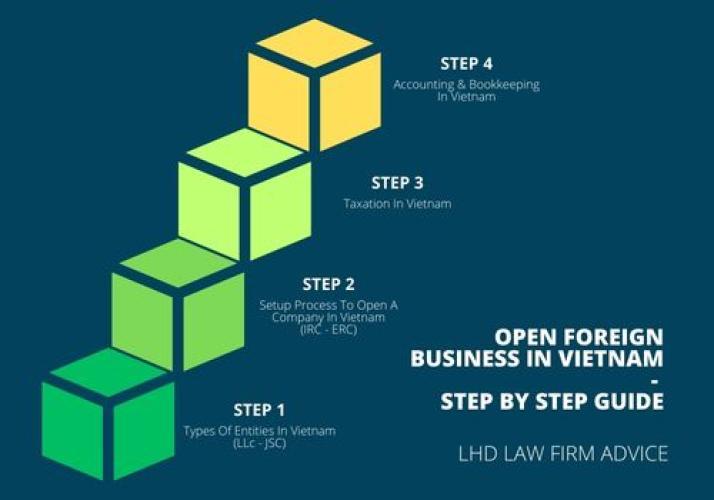

OPEN COMPANY IN HA NOI - STEP BY STEP

Step 1: Register the Investment Registration Certificate

If you're looking to officially open a business in Vietnam that is owned by foreign investors, you must obtain an Investment Registration Certificate from the Department of Planning and Investment. This certificate will provide the necessary permissions for your company's operations.

How long does it take to obtain this certificate? The application process usually takes around 30 days.

However, if no WTO regulations or local laws govern foreign ownership in that sector, obtaining the certificate may require extensive time and effort. Your business must obtain authorization from one or more ministries at an executive level for this to occur.

Business Registration Certificate

Documents of investor need

| No | Filename | Amount | Notarization in foreign countries | Request for consular legalization | Made in Vietnam |

| 1. | Certificate of establishment / Business license for institutional investor

Passport/identity card for investors is and n |

02 | Have | Have | Translated into Vietnamese, Notarized |

| 2. | Audited financial statements for the last 2 years of the investor; or the parent company’s financial support commitment; or a financial institution’s commitment to financial assistance; or guarantee for investor’s financial capacity; or Confirm the investor’s bank account balance relative to the intended capital to invest in Vietnam. | 01 | Have | Are not | Translated into Vietnamese, Notarized |

| 3. | Passport / ID card notarized representative of company law in Vietnam | 02 | Have | Have | Translations into Vietnamese, the c hun g |

| 4. | Office lease contract, Document proving the lessor’s right to lease in Vietnam (Land use right certificate, Construction permit, Business registration certificate with real estate business function of the lessor or equivalent documents ) | 01 | Notarized | ||

| 5. | Legal investors need to provide:

– Passport of investor’s legal representative. |

01 | Have | Have | Translated into Vietnamese, Notarized |

Authority to issue the Investment Registration Certificate:

-

The management boards of industrial parks, export-processing zones, hi-tech zones and economic zones shall be responsible for the issuance, revision, and revocation of investment registration certificates relating to all investments within their respective areas.

-

The Planning and Investment Service is responsible for receiving, issuing, adjusting, and revoking Certificates of Investment Registration for projects located outside industrial parks, export-processing zones, hi-tech zones, and economic zones; with the exception stated in the following case.

-

The Planning and Investment Service of the provincial jurisdiction where the investor intends to set up their head office or operating outlet for executing the investment project must receive, issue, modify and revoke Certificates of investment registration:

-

Any venture that requires expansion into multiple provinces;

-

Any investment venture executed in industrial parks, export-processing zones, hi-tech zones, and economic zones alike can be highly profitable.

The dossier you need to prepare to apply for the Investment Registration Certificate

-

A formal request for authorization to carry out the investment project;

-

If you are an individual investor, please provide a copy of your ID card or passport. On the other hand, if you're investing on behalf of an organization, submit a copy of its Certificate of Establishment or any other document that can validate its legal status.

-

This investment proposal provides detailed information on the project, such as: who is investing in it, what the objectives are and how much money they plan to raise; where it will take place and for how long; estimated labor needs, requested incentives from investors and expected socio-economic effects.

-

To confirm financial stability, the investor must present copies of their last two years' financial statements, a letter from their parent company vouching for financing support, an assurance from any affiliated banks that they are willing to provide funding assistance when necessary, and further documentation outlining the investor's creditworthiness.

-

This office lease agreement requires that the lessor present documentation to prove their right (such as a Certificate of Land Use Right, Construction Permit, and Certificate of Business Registration with real estate business function or similar documents) before they can be approved.

-

To complete this project, it is essential to obtain permission from the state government for land use. If the leased or allocated land by the State has not been used or its purpose changed with a permit, then investors must submit a copy of their lease agreement along with other documents as proof that they have the authority to utilize these premises.

-

The law on technology transfer restricts the application of certain technologies, which includes providing names and origins; a process diagram; specifications of machinery, equipment, and primary technological line; as well as conditions for their use. This is all outlined in the List of Technologies section.

If the project is conducted under a business cooperation contract, then this document will act as a formal agreement.

Register for your Investment Registration Certificate

-

To begin, the investor must register their investment project information on the National Foreign Investment Information System in order to declare it online.

-

Within 15 after submitting an online application, investors must present their file to the Investment Registration Authority in order to secure their Investment Registration Certificate.

-

Following receipt of the application, investors will then have access to an online account and be able to utilize the National Foreign Investment Information System which allows them to monitor their application's progress and results.

-

If your investment registration is successful, the investment registration agency will issue a code through this account to complete your project;

-

Should the application end up being denied, this agency must provide written notification to the investor and elucidate why it was rejected.

Step 2: Register the Bussiness Registration Certificate

Once obtaining the Investment Registration Certificate, the investor may then proceed with registering a business. This can be achieved by establishing:

-

A Limited Liability Company (LLC)

-

Joint Stock Company (JSC)

-

Partnership

-

Sole Proprietorship

For LLCs, it is necessary to open an online business registration portal and submit the required documents, such as a copy of the Investment Registration Certificate and the applicable legal documents.

The company must also have at least two founders who are either Vietnamese citizens or foreign investors with valid identification cards. Theoretically, each founder can hold up to 50% of ownership in the company; however, this percentage is usually limited to 49% for foreign investors depending on the size of their investment.

The company's name must be registered with the National Business Registration Portal and is subject to approval from the Department of Planning and Investment. Once approved, a ‘Business Registration Certificate’ will be provided to confirm the registration. The certificate must include information about the company such as its name, address, and business code.

The registration process is relatively simple if all documents are completed correctly; however, the processing time can take anywhere from 7 to 30 days depending on the complexity of the project.

Finally, investors should bear in mind that costs vary depending on the size and type of their businesses in Vietnam.

The dossier includes:

-

A business registration application form;

-

The company’s charter;

-

A list of members (for limited company) or stakeholders (for joint-stock company);

-

Certified copies of:

-

Copies of the ID card or other ID papers of members being individuals;

-

Decision on Establishment, Business Registration Certificate, or an equivalent document of the organization and the letter of authorization; the ID card or other ID papers of the authorized representatives of members being organizations. If a member is a foreign organization, the copy of the Certificate of Business registration or an equivalent document must be consular legalized;

-

The Investment registration certificate of the foreign investors as prescribed by the Law on Investment

To finalize your business registration, you must submit the application dossier to the National Business Registration Portal within 03 – 05 days. Once approved, a Business Registration Certificate will be issued.

Afterward, it is mandatory that an announcement is published on the same portal within 30 days of being granted a said certificate in accordance with set procedures and regulations.

Step 3: Register the Bussiness License for Conditional Business Lines

Should the Company decide to retail goods or open a shop, its establishment shall be subject to certain applicable laws:

-

As per Decree 09/2018/ NĐ-CP which stipulates the rules for goods trading and activities associated with the purchase and sale of commodities by foreign investors as well as organizations having foreign investment capital in Vietnam, retail is defined as a process of selling merchandise to individuals, households, or other businesses for consumption. Consequently, investors are not obliged to acquire a business license if they wish to export, import, or wholesale goods that do not belong in the categories of oil, lubricant, rice, sugar; video items; books; newspapers, and magazines. However, when it comes to retailing goods at commercial establishments and selling them through physical stores setting up shop is essential in order for one to be granted proper permission.

For any foreign investors seeking to conduct inbound international travel, their scope of business must be contained solely in bringing tourists from abroad into Vietnam.

Understanding the Legal Advantages of Company Formation in Hanoi, Vietnam

Ha Noi company formation, offers numerous advantages for foreign investors. This article delves into the legal benefits and considerations that make Hanoi an attractive destination for company formation.

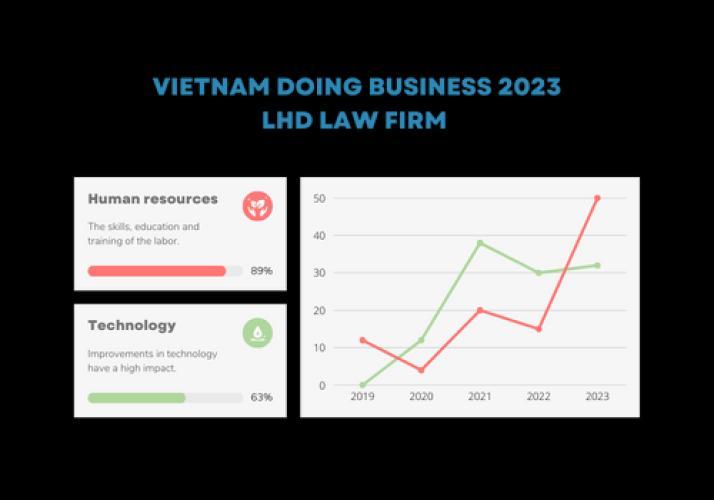

- Access to a growing economy

Vietnam has experienced impressive economic growth in recent years, driven by factors such as a young, dynamic workforce, increasing domestic consumption, and a shift in manufacturing bases from countries like China. By setting up a company in Hanoi, you can benefit from the nation's economic growth and potential.

- Favorable investment environment

The Vietnamese government has introduced policies and incentives to attract foreign investment, such as tax breaks, reduced corporate income tax rates, and investment incentives in specific industries or geographical areas. By establishing a company in Hanoi, you can take advantage of these incentives and enjoy a more favorable investment climate.

- Strategic location

Hanoi, as the capital city, is a hub for business, government, and cultural activities. Its strategic location in Northern Vietnam offers easy access to other major cities, such as Ho Chi Minh City and Da Nang, and regional markets, including China and the ASEAN countries. This makes Hanoi an ideal base for company operations and expansion in the region.

- Clear legal framework

Vietnam has developed a comprehensive legal framework for foreign investment, which covers areas such as company formation, labor, taxation, and intellectual property. Establishing a company in Hanoi allows you to operate within a clear legal environment, reducing uncertainties and risks associated with conducting business in a foreign country.

- Intellectual property protection

Vietnam has made significant strides in improving its intellectual property (IP) protection regime. As a member of the World Intellectual Property Organization (WIPO) and a signatory to several international IP treaties, Vietnam has implemented IP laws that are more in line with international standards. By setting up a company in Hanoi, you can benefit from these improved IP protections for your business.

- Access to a skilled workforce

Hanoi boasts a well-educated and skilled workforce, with a strong emphasis on technology and engineering. As a foreign company, you can tap into this talent pool, which can contribute to the success and growth of your business.

HANOI COMPANY FORMATION ADVICE BY LHD LAW FIRM

Company Fomation in Viet Nam advice by LHD, we are a consulting company specializing in business law. We provide professional consulting services specializing in the fields of busines: Vietnam company formation, Setup a company in Viet Nam, Setup rep office in Vietnam, intellectual property: Register trademark in Vietnam , contracts and commercial disputes. With tradition of thickness, LHD law firm always committed to provide customers consulting services to professional quality and reliability with the highest creative solutions, all for the issues of business …

LHD law Firm is a leading provider of legal services in the region with a well-diversified team of experienced lawyers, consultants, and assistants located in Ho Chi Minh City and Hanoi.

LHD law firm offers comprehensive legal advice and innovative solutions for a wide range of customers and legal issues. LHD law Firm specializes in commercial law, arbitration, and related litigation, tax, investment project, enterprises including set up a 100% foreign owned capital company (WFOE) or joint venture company (JVC),establish a representative office, establish a branch of foreign companies in Vietnam; Consulting finance, accounting; industrial proprietary representation service, M&A and other legal services… Whether our clients are looking to establish new business, grow, expand or restructure existing business, or need assistance to settle disputes, the team at LHD law Firm is ready to provide practical and timely advice and outstanding service.

Your visits to LHD law firm will involve a team of experts who are trained to listen actively to your needs, concerns and priorities. Based on the information discussed, a team is created to provide effective and efficient services on your behalf. In addition, you will have the combined knowledge, experience and substantial resources of everyone at LHD law Firms working for you.

0 comment