Cost To Incorporate In Vietnam Business - Overview, Step By Step, Total Fees

- 11/01/2022

CONTENT

CONTENT

CONTENT

CONTENT

Cost to incorporate in Vietnam business

Discover, Cost to incorporate in Vietnam business - Overview, step by step, total fees, Incorporation in Vietnam is used to refer to a group of companies that work together, or a group of subsidiaries that have come together to form one large company. LHD Law Firm Advise →

The condition for this company to exist is that the company must jointly donate shares and build together to develop the group. Conversely, if a corporate subsidiary is having difficulty, the entire group will work together to help the individual overcome the difficulty. How much does it cost to incorporate a business in Vietnam? What are the strengths and weaknesses of this type of business in Vietnam? The answers to these questions are below.

Elements of incorporated in Vietnam Business

When deciding to set up a business, it must first choose the state in which it will be incorporated (INC). Then the following steps are performed:

-

Trade Name: The company chooses a name and does a search to make sure it is not used by another company in that country or state.

-

Type of legal entity (type of legal entity): The following legal entities for which you must select a legal entity type are S legal entity (the legal entity has a pass-through tax obligation to prevent the legal entity from paying tax, but shareholders pay tax), C legal entity (paying corporate tax), or LLC.

-

Board of directors: It is necessary to appoint a person who will serve as a director.

-

Share (share): Companies need to determine the types of shares they will issue to shareholders. This may usually include priority or sharing, with or without voting rights.

-

Registration agent: The company must specify someone (country or state) who can receive legal documents on behalf of the company.

-

Articles of incorporation: The company submits the articles of incorporation to the state and pays the fee.

-

Articles of Association: Companies must have Articles of Association, which are rules on how to conduct business.

-

Issue shares: Once the company is established, it can issue shares to shareholders.

The composition and procedures to incorporated in Vietnam are relatively complicated

Documents to form a incorporated

-Business registration application.

-Company regulation.

-For a joint-stock company, a list of members of a limited liability company with two or more members, a list of partnerships, founding shareholders and shareholders who are foreign investors. A list of official representatives of the organization's foreign shareholders.

-A valid copy of the following document:

+ If the founder of the company is an individual, it is one of the personal identification documents.

+ Establish decision or company registration certificate or other equivalent document, one of the personal identification documents specified in Article 10 of this decree of the authorized representative, and equivalent attorney authority. When the person who establishes the company is an organization.

+ Investment registration certificate. When a company is established or participated by a foreign investor or an economic organization with foreign investment capital in accordance with the provisions of investment law and other regulatory documents and other laws.

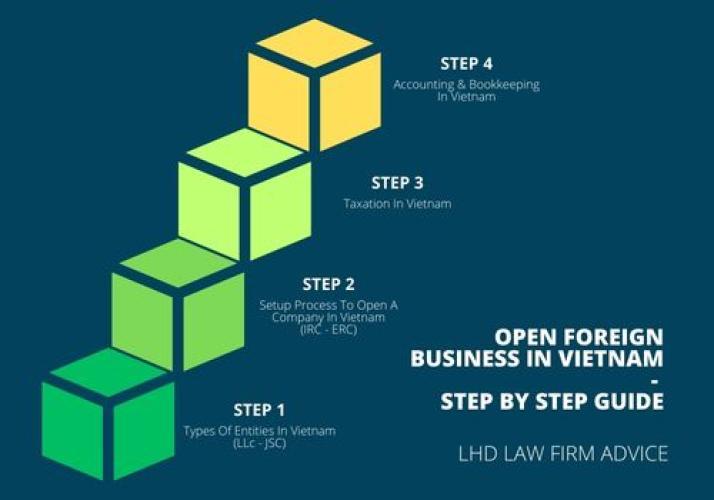

Steps to incorporate in Vietnam Business

Vietnam has a very bureaucratic and strict business building process. It takes about 45 working days to formally register a company.

This is done through the 24/7 online portal of the National Business Registration System (NBRS). The online platform provides users with videos that guide them through the various steps and documents required to register as a company.

Steps to establish a business in Vietnam according to the law of this country

Step 1: Define the business scope

Vietnam is known as a country with a lot of foreign company ownership. In most economic sectors, Vietnam allows 100% foreign capital. However, there are some restricted sectors and foreign ownership, subject to ministerial approval.

Therefore, the first step is to determine the type of business and whether foreign ownership is required.

Step 2: Minimum capital requirement for inc in Vietnam

While there is no definite capital regulation/requirement, Vietnam requires a minimum capital level that reflects the type of business you are involved in.

The minimum total capital is about 10,000 USD. At this stage, you must submit your application to the Ministry of Planning and Investment. It can only be renewed after it has been approved by the Investment Registration Certificate (IRC).

Step 3. Get an actual legal address

Proof of the proposed business address is required, submitted with the application.

Step 4: Determine the internal management structure

Official documents are required to confirm the official appointment of the head.

As mentioned earlier, at each stage of company registration there are video tutorials on the documents and steps involved. This video tells users about the requirements for choosing a company name.

How much does it cost to incorporate a business?

Here are some of the key costs that a Vietnamese company registration consultant should consider when setting up a company in Vietnam.

1. Capital investment

This is the largest startup expense category in Vietnam. This is the initial investment in a business that needs to be made before the business can survive. Some companies have special capital requirements (as required by law) to invest in their business. However, most companies do not set a minimum amount. Investors need to make a decision and commitment during the registration process. These capital investments must be made by the company within 90 days of the license being issued.

2. Cost of a business address

One of the main requirements to set up a business in Vietnam is to have a registered office. The address of the business does not coincide with the address of residence. This was met by presenting a lease stating the reason for the company's registration.

These types of expenses are not fixed, as they depend on how much the potential owner is willing to spend

3. Registration fee

These include application preparation costs (notarization, legalization), state fees, and services paid to the facilitator or agency to complete the registration process.

4. Taxes

After successful registration, the company will be subject to license tax. This license tax is an annual membership fee paid in the first month of the fiscal year. During the 30-day grace period, the treasury will be paid $100-200. Failure to pay this tax will result in a penalty or denial of access to the Tax Code. When a company starts to have income and profits, it will have to pay more taxes.

Before starting a business in Vietnam, you first need to understand the cost structure of starting a business. Knowing what and where you need to spend your money, you'll be able to see the big picture before making investment decisions and budgeting. It will also help you decide how to reduce the cost of what you don't need and how to find a cheaper alternative.

What makes your incorporated fees increase?

Foreign investors who want to start a business in Vietnam must meet other legal requirements. They need to choose the appropriate type of building to apply for and apply for specific permits and special permits. In addition, investors should also consider the cost of starting a business in Vietnam, so as not to be surprised when coming to Vietnam.

The cost of starting a business should be considered separately from the capital requirements.

Each business field has a different incorporated fee

Fields of Incorporated

It should cost at least $7,000 to set up an e-business company in Vietnam. The fee does not include 10% VAT and the cost of translating documents prepared by you from English to Vietnamese ($10/150 words), as well as the actual travel and accommodation costs of the lawyers.

To set up a service company in Vietnam, it costs at least 4,000 USD. The fee does not include 10% VAT and the cost of translating documents prepared by you from English to Vietnamese ($10/150 words), as well as the actual travel and accommodation costs of the lawyers.

Company support for incorporated in Vietnam Business

The procedure for setting up a company in Vietnam is still a barrier for investors. The company that supports the incorporation of a business with its legal capacity can shorten the time of company establishment and save costs incurred.

Taxes

To assist companies affected by COVID-19, the Government has issued Decree No. 52/2021 to extend tax and space rent payments from the signing date of April 19, 2022, to 2021.

CIT has no concept of tax residence. Business organizations established under Vietnamese law are subject to corporate income tax and global income tax. 20% tax on corporate income on income from abroad. There are no tax incentives for such income.

Not sure where to start doing business in Vietnam and the cost to incorporate in business? Our team of legal experts and professional advisors will be happy to assist you. Whether you need help registering a company or getting a visa to work in Vietnam, we can help you with all the challenges you will face when doing business in Vietnam.

LHD LAW FIRM ADVISE →

Our lawyers and practitioners have maintained an investment consulting practice since 2006 placing us in the best position to advise and provide comprehensive services to foreign investors on the establishment and operations of their investment projects in Vietnam, as well as to provide legal advice on all aspects of the Vietnamese law on investment. Foreign individuals or entities can take advantage of our comprehensive services as follows:

Policies and Conditions

- Offering up-to-date advice on policies, the road map of implementation of Vietnam’s WTO commitments and market conditions in areas open to foreign investment in general and/or in investor’s specific business sector(s) with detailed analyses on advantages and disadvantages of various scenarios;

- Advising on the possibility of obtaining an Investment Certificate for the specific project of a prospective investor in Vietnam with analyses on technical barriers and conditions by laws and consideration of possible changes necessary to have the project accepted by Vietnamese Authorities;

- Advising prospective investors on the appropriate forms of direct and indirect investment available under the laws of Vietnam with comparison of advantages and disadvantages of each form of investment to simplify the investor’s choice.

Document Drafting and Negotiations

- Offering detailed advice on procedures and documents required for particular projects, and assisting investors in the drafting of project-related documents; reviewing and advising on all legal aspects of project-related documents;

- Representing investors in legal negotiations with their business partners concerning the project-related documents;

- Providing all other support services, such as printing, translations, editing, notarizing, etc.

Securing Investment Certificate

- Representing investors in the submission of application dossier to the proper Vietnamese authorities and following up the appraisal of the application dossier by these Vietnamese Authorities;

- Representing investors in the submission of application dossier to the proper Vietnamese authorities and following up the appraisal of the application dossier by these Vietnamese Authorities;

- Obtaining Investment Certificates for projects.

Other Services

- Advising investors on the legal aspects of office leases and other land-related matters for construction of projects, labor and employment, company working regulations, business contracts, etc.;

- Assisting investors in locating land sites which would best meet with requirements of investors’ investment projects.

Email: all@lhdfirm.com

1 comment

Mind

How to Starting a Business in Vietnam ? Fees, time of work and process !

Send comment