Is It Easy To Establish And Run New Business In Vietnam ?

- 13/07/2022

CONTENT

CONTENT

CONTENT

CONTENT

☆ Is it easy to establish and run a new business in Vietnam?

In Vietnam, we have a very simple business registration and establishment policy. For example, some companies and corporations can have up to 100% foreign capital. You can hire an unlimited number of foreigners to work for your company.

Vietnam is one of the potential destinations for foreign investment in recent years. Many organizations and individuals have investment and start-up needs in Vietnam. In particular, the type that attracts a lot of people's attention is the private enterprise. Setting up and operating a business in Vietnam is easy if you have a good grasp of the law and the market.

Advantages of establishing and running a new business in Vietnam

Starting a business in Vietnam will bring you great benefits. We have summarized some key points for your reference.

Tax incentives

First, you need to have a basic understanding of taxing business and investment activities in Vietnam:

It should be noted that there are several tax benefits to doing business in Vietnam. New investment projects can enjoy tax incentives based on sector, location and size. In addition, if you undertake an expansion project, you will be entitled to CIT incentives if certain conditions are met.

Vietnam provides tax support for foreign investors

High growth economy plus potential market

Vietnam is a dynamic emerging market with endless potential that is valued at the top of Asia. In 2020, Vietnam's inflation will continue to be controlled at 3.2%. Compared to the target of 4%, this is a good result to help stabilize prices in the domestic market.

From the development of a centralized economy to a market orientation, Vietnam's purchasing power is measured by a population of 97 million people. The country also ranks among the 15 most populous countries in the world. Finally, Vietnam is one of the leading countries in terms of growth and development.

In particular, the introduction of EVFTA, CPTPP and EVIPA in 2019 has brought positive values to the Vietnamese market as well as foreign investment in the coming period.

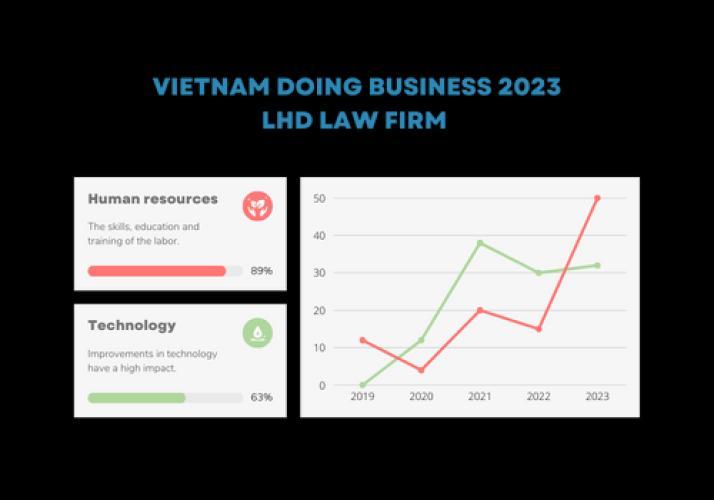

Competitive labor prices and qualifications

If you are a foreigner who wants to do business in other countries, labor costs may be one of your concerns.

Starting a business in Vietnam will help you eliminate this concern because the domestic labor cost is quite low and competitive. Vietnam has a young population and potential workforce. Notably, the country's average wage costs are more competitive than those of neighboring countries like China. The skill of Vietnamese workers is relatively high, providing a perfect production line.

According to statistics, the cost of production labor per hour in China is 6.5 USD in 2020, while in Vietnam, this cost is only about 3 USD.

Vietnamese workers are good and accept lower wages than other developed countries

National legislation and institutions are favorable for business people today

Vietnam has made considerable efforts in improving its legal and institutional framework.

Vietnam's management system is supported by an open business environment, transparent investment policies and profit-based corporate incentives. In general, the Enterprise Law and Investment Law 2015 are the basic laws governing the establishment and operation of companies in Vietnam.

These laws regulate the business rights of individuals who are allowed to do business in the areas where they are allowed to do business and relieve all kinds of administrative troubles for businesses.

In addition, the private sector and foreign direct investment also receive more favorable conditions due to these laws. The improvement of Vietnam's management mechanism has contributed to enhancing Vietnam's position in the international arena. The country ranks 70th out of 190 economies in the World Bank's Doing Business 2020 report.

Doing business with the support of the internet and e-commerce platform in Vietnam

You don't have to be in Vietnam on a regular basis to run a business here. With a dense internet network and e-commerce system, you will always know the company's performance and develop new strategies. After the Covid epidemic period, Vietnam allowed citizens to freely enter and exit and gradually lifted restrictions. So this is the golden time to establish a company in Vietnam.

Challenges of establishing and running a new business in Vietnam

High corporate tax rates on certain investments

Vietnam applies the usual corporate income tax rate of 20% for most corporate entities. However, for some specific industries and business lines, the tax rate is quite high.

For example, if you are actively engaged in exploration and production in the oil, gas and other natural resource industries, you will be taxed at 32% and 50% depending on location and project circumstances.

Foreign currency restrictions

You need to convert foreign currency to Vietnam Dong for indirect investment in Vietnam. In general, transactions, payments, referrals, advertising and other forms must also be made in Vietnam Dong.

However, the flow of foreign currency into Vietnam has been more open and less restricted. Likewise, remittances are less severe.

If you plan to live in Vietnam for work purposes, you can remit your profits abroad if you have fulfilled all your financial obligations to the Vietnamese government.

It is illegal to use foreign currency in Vietnam

Solving human resource problems when operating the business

SMEs often send senior employees to Vietnam to live and work, but due to high costs, the parent company has insufficient human resources and the number is limited. There are also options for salespeople and technicians who do not have sufficient experience and expertise in accounting, taxation and management to avoid being controlled. Foreign working environment is preferred.

These employees, in addition to facing cultural differences, language differences, etc., spend a lot of time on administrative work in addition to their main job responsibilities, so their responsibilities are heavy. Therefore, it is necessary to take a lot of measures to help these employees reduce the burden. Employees need to develop relationships with colleagues and trusted friends to support each other during difficult times. In addition, the new working environment and management of the workshop also brought more pressure to them. Those importing from abroad need to find their own way to relieve stress.

A frequent concern of foreign companies investing in Vietnam is how to reduce the turnover rate of Vietnamese employees. Basically, foreign companies can reduce this rate by creating a friendly working environment through allowances and benefits.

Foreign investors need to understand that Vietnamese people's thinking and activities are completely different, so foreign knowledge cannot be applied. Participation has become a habit, foreign investors need time to get used to the Vietnamese way of working and gradually change their way of thinking to be able to do business easily and conveniently.

Matrix of procedures for setting up a company in Vietnam

According to the PCI 2020 report, it also points to a number of issues that businesses are still concerned about the quality of procedures, regulations, infrastructure and public services compared to other countries in the region such as China, Thailand, Singapore, Indonesia, Malaysia... Only about 42% of FDI enterprises said that Vietnam's public service delivery quality is better than other countries in the region. Compared with other countries in the region, the stages and steps in tax and social insurance management procedures of domestic enterprises and foreign-invested enterprises still have many shortcomings.

You have to go through many procedures for setting up and operating a company

Conclusion: Setting up and operating a business in Vietnam is a challenge, but has a lot of potential

Before investing in Vietnam, investors need a preliminary survey to assess the possibility of doing business in Vietnam (such as studying the feasibility and profitability of projects). There are many cases of failure due to investors not doing enough market research before investing. To avoid this risk of failure, Small and Medium Enterprises (SMEs) need to conduct a preliminary investigation (study of raw material supply, customer demand, infrastructure system, etc.) into Vietnam. infrastructure, distribution channels, tax, accounting, banking, recruitment, labor and documentation costs) to assess business viability in Vietnam.

Information from investors shows that Vietnam remains an interesting destination in ASEAN and Asia, where they can diversify production areas, reduce risks and strengthen supply chains. In addition, Vietnam is also a potential labor market; they value a highly skilled, fast-absorbing and reasonably priced workforce.

In addition, sales goals and sizes need to be planned in detail and staff trained to be profitable within 3-5 years. New business owners need to take time to adapt to new procedures and also need to understand rising labor costs. In addition, employee-to-employee training, continuous improvement efforts to increase profits are very important even at the beginning of the operation.

Benefits of investing in Vietnam

Vietnam is one of the most promising destinations for foreign investors. After the first few months of 2020, FDI inflows into Vietnam have increased sharply in recent months, partly a sign of a new investment wave as Vietnam joins free trade agreements. Experiencing a difficult epidemic in 2021, Vietnam has made a breakthrough in the economy with a growth rate of up to 6%. If you want to make your business in Vietnam easier, consult local legal experts to avoid legal trouble.

☆ Our service portfolio includes →

- In-coming Foreign Investment (Company Incorporation)

- Feasibility Studies and Due Diligence Reports

- Market Surveys, Researches and Analyses

- Setting up Business Entities & Cross-shareholding

- Venture Capital & Cross-Shareholding

- Merger & Acquisitions, Sales & Disposals

- Management & Corporate Administration Services

0 comment