Doing Business In Vietnam - Book A Free Consultation

- 01/12/2025

CONTENT

CONTENT

CONTENT

CONTENT

★ Doing business in vietnam | LHD Law Firm guide Step and step...

With its impressive economic growth and strong ability to attract foreign direct investment, Vietnam is increasingly becoming an attractive destination for foreign investors. Today LHD Law Firm will share an overview of the necessary information about doing business in Vietnam.

Why should you do business in Vietnam?

Critical position

Vietnam is strategically located in the heart of ASEAN and shares borders with the Pacific Ocean, Thailand, Laos, Cambodia, and China. This creates favorable conditions for Vietnam in international transportation and trade.

Moreover, Vietnam is located near the manufacturing hub of southern China, one of the world's largest economies. Thanks to this proximity, Vietnam has become an attractive destination for investors who want to access the supply chain from China.

Preferential and transparent legal corridor

In recent years, Vietnam has made considerable efforts in improving its legal and institutional framework. In January 2021, the National Assembly of Vietnam passed the Law on Investment and the Law on Enterprises (Amendment). This change has made the business registration process in Vietnam simpler and easier. The Vietnamese government also added many incentives related to tax and land rent for foreign investors in Vietnam.

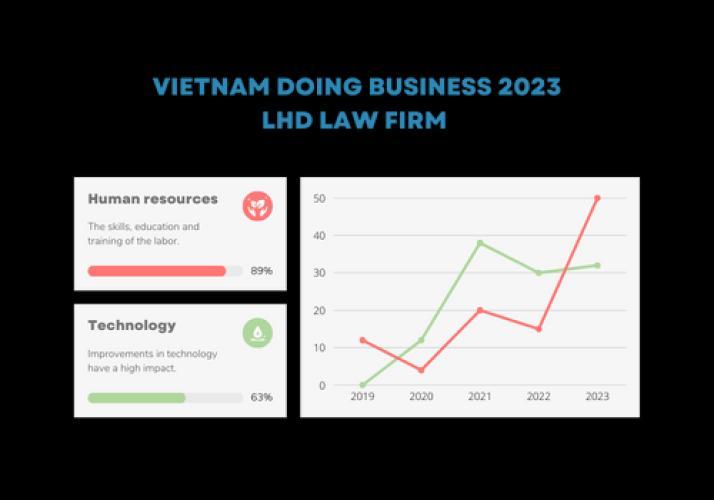

Young, high skills, and low costs labor

Vietnam is a country with a young population. It has a total population of 96 million, of which more than 45% is between 25 and 54 years old.

The young population promises high purchasing power and labor productivity.

The qualifications of workers in Vietnam are highly appreciated. Specifically, Vietnam currently has 97% of the population of working age literate. Vietnamese workers are also famous for their hard work, good intellect, professional attitude, and proficient professional skills.

The Vietnamese workforce is skilled yet affordable, allowing companies to easily expand operations on a much lower budget than in China and India.

Government and FTA support

The Vietnamese government has actively engaged in global trade to attract foreign investors and encourage business development.

Vietnam is currently a member of many important trade agreements such as CPTPP; EVFTA; AFTA; VJEPA; VKFTA; AKFTA; VN – EAEU FTA…. Accordingly, Vietnam will open its borders to many businesses, creating a strong impetus for the comprehensive cooperative partnership between Vietnam and its member countries.

Open economy and impressive growth rate.

Vietnam's economy is an open market economy, the Vietnamese government encourages foreign investors and always creates a non-discriminatory mechanism on the nationality of businesses in the Vietnamese territory.

Since 2015, Vietnam's average economic growth rate has been 38% per year, which is considered the top in Southeast Asia along with Indonesia.

In 2021, the total foreign direct investment capital into Vietnam will reach 31.1 billion USD. Vietnam is in the top 20 countries attracting the largest FDI inflows in the world (According to the World Investment Report 2021 of the United Nations Conference on Trade and Development 2021).

The average annual GDP growth rate of Vietnam in the period 2014-2019 is 6.76%, while the average GDP growth rate of the world is only 3.05% (According to the World Bank). Vietnam is also one of the few countries to maintain economic growth until 2020 when the pandemic broke out.

Vietnam is also rated by nearly 80% of foreign enterprises very positively or positively about the medium and long-term prospects when investing in this country (According to the American Chamber of Commerce in Vietnam).

Types of enterprises for foreign investors to do business in Vietnam

Foreign investors can choose the following forms when doing business in Vietnam:

Limited liability company with two or more members

A limited liability company with two or more members is an enterprise with between 2 and 50 members who are organizations or individuals. Members are responsible for the debts and other business's property obligations within the amount of capital they have contributed to the enterprise.

A limited liability company with two or more members may not issue shares, except for cases of conversion into a joint stock company.

A limited liability company with two or more members may issue bonds; the private placement of bonds must comply with the law.

Single-member limited liability company

A single-member limited liability company is an enterprise owned by an organization or individual. The company owner is responsible for the company's debts and other property obligations to the extent of the company's charter capital.

A single-member limited liability company may not issue shares, except in the case of conversion into a joint stock company. A single-member limited liability company may issue bonds; the private placement of bonds with the law.

Joint Stock Company

A joint-stock company is an enterprise that has its charter capital assigned into equal parts called shares. Shareholders can be organizations or individuals. The minimum number of shareholders is three people. There is no restriction in regard to the maximum number of shareholders.

Shareholders are only responsible for the debts and other business's property obligations to the extent of the amount of capital contributed to the enterprise. Shareholders have the right to freely transfer their shares to others shareholders.

A joint-stock company has the right to issue shares, bonds and other securities of the company.

Partnerships

A partnership is an enterprise with at least 02 members who are co-founder of the company, doing business together under a common name. In addition to general partners, the company may have additional capital contributors.

A partnership company has legal status from the date of issuance of the Certificate of Business Registration.

Partnerships may not issue securities of any kind.

General partners and capital contributors must contribute in full and on time the committed capital amount. General partners who fail to contribute in full and on time the committed capital, causing damage to the company, shall be responsible for compensating the company for damage.

In case a capital-contributing member fails to contribute in full and on time the committed capital amount, the unpaid capital amount shall be considered as a debt of that member to the company. In this case, the relevant capital-contributing member may be expelled from the company by decision of the Members' Council.

Private enterprise

A sole proprietorship is a business owned by an individual. He/she is solely responsible with all his assets for all business activities.

Each individual is only entitled to establish a private enterprise. The owner of a private enterprise cannot concurrently be the owner of a business household or a general partner of a partnership.

A private enterprise is not entitled to contribute capital to the establishment or purchase shares or contributed capital in a partnership, limited liability company or joint-stock company. Private enterprises may not issue securities of any kind.

Investment capital of a private enterprise owner is registered by himself. The owner of a private enterprise is obliged to accurately register the total investment capital, clearly stating the capital amount in Vietnam Dong, freely convertible foreign currencies, gold and other assets; for capital in other assets, the type of property, quantity and residual value of each type of property must also be clearly stated.

Preferential policies when investing in Vietnam

Rights of foreign investors in Vietnam

According to the Investment Law 2014, foreign investors have the following rights:

-

Foreign investors may conduct business investment activities in industries and trades not prohibited in this law.

-

Investors decide on their investment and business activities with this law and other relevant laws; access and use credit capital, support capital, land use, and other resources as prescribed with this law.

-

The State recognizes and protects the ownership rights to assets, investment capital, income, and other rights and interests of investors.

-

The State treats them fairly, adopts policies to encourage and create favorable conditions for investors to invest in the business, and develops sustainably all economic sectors.

-

The State respects and implements international treaties related to business investment to which the Socialist Republic of Vietnam is a contracting party.

Protection of capital of foreign investors according to Vietnamese law

According to Article 5 of the Investment Law 2014 and WTO commitments as well as free trade agreements with countries around the world, Vietnam has the following regulations on protecting investors' capital:

-

No nationalization or requisition of protected investments of investors, except for public purposes, is done through a legal process, on a non-discriminatory and remunerated basis. timely, complete, and effective compensation.

-

The level of compensation as prescribed above must be equal to the actual value of the protected investment property before being requisitioned or at risk of being requisitioned; Compensation may include interest on late compensation.

-

In case Vietnam is the requisitioning party, the requisition directly related to the land must ensure that the purpose of the use with the current law of Vietnam and compensation is equivalent to the market price.

Tax incentives for foreign investors

Incentives on corporate income tax

Foreign-invested enterprises are entitled to foreign corporate tax incentives when implementing investment projects in industries or areas with investment incentives.

Newly established enterprises are eligible to enjoy the tax rate of 10% within 15 years from the first year of the investment project with taxable income, income tax exemption for four years and 50% reduction of corporate income tax business for no more than the next nine years.

Newly established enterprises with investment projects located in areas with difficult socio-economic conditions, agricultural service cooperatives or people's credit funds are entitled to the tax rate of 20% within 15 years from the first year of investment project has taxable income, income tax exemption for 02 years and 50% reduction of corporate income tax for no more than 04 subsequent years.

Preferential import and export tax

Investment projects are exempt from import tax on goods imported to create fixed assets, raw materials, supplies or components for project implementation.

Incentive on loss transfer tax

Enterprises with losses will be able to carry forward this loss to the following year and be deducted directly from taxable income. The time to enjoy the preference for loss transfer shall not exceed 05 years from the year following the year in which the loss is incurred. Enterprises operating at a loss from the field of real estate transfer are only allowed to transfer the loss into the taxable income of this activity.

Incentives on land use tax

Agricultural projects with special investment incentives or incentives are exempted or reduced from land rental, land use or land use tax.

Some frequently asked questions about doing business in Vietnam

What are the common real risks for FDI enterprises and foreigners investing and doing business in Vietnam?

According to experience from foreign investors in Vietnam, the main challenges when doing business in Vietnam are:

-

Corruption and bureaucracy

-

Lack of enforcement of Intellectual Property Rights (IPR)

-

Inadequate infrastructure

-

Workers lack skills

-

Language differences (so often need interpreters and translators)

In which areas can investors legally invest in Vietnam?

Foreign direct investment (FDI) is now very important for Vietnam in promoting economic growth. They account for nearly 70% of the country's exports.

Recognizing the aforementioned role of FDI in Vietnam's economic system, the Government of Vietnam has revised the relevant laws on foreign investment to encourage foreign investors to invest in Vietnam. Currently, 100% foreign ownership is allowed in most of the sectors allowed under Decree 60/2015. The Vietnamese government is committed to supporting and creating the most favorable conditions for foreign businesses to invest and operate in Vietnam.

What taxes must a foreign-invested company pay?

Like Vietnamese-owned enterprises, foreign-invested companies also have to pay some basic taxes as follows: Value-added tax, license tax, corporate income tax, import-export tax (if any) import and export activities)

What are the conditions for foreign-owned companies to trade and distribute goods in Vietnam?

A foreign-owned company conducting commercial activities and distributing goods in Vietnam has the following conditions:

-

Investors from countries and territories participating in international treaties to which the Socialist Republic of Vietnam is a contracting party commit to open the market for goods trading activities.

-

Distributed goods are not on the list of goods banned from business and are not allowed to be distributed under international treaties, but must be distributed according to the committed schedule of international treaties if they are on the list of goods with a distribution route.

-

Scope of distribution: wholesale and retail.

-

Be Issued Business License by a competent state agency.

|

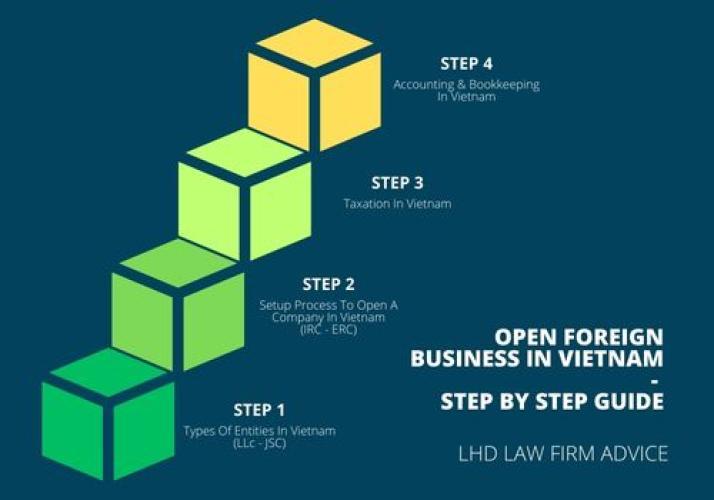

Vietnam persevered through a difficult 2021 as the COVID-19 pandemic took a significant toll on its economy and people. The country went through a strict lockdown in the middle of the year, which lasted almost five months, forcing businesses to halt production and disrupting global supply chains. Residents, particularly in commercial hub Ho Chi Minh City and the southern provinces, were forced to stay at home and only go out for emergencies. The result was that Vietnam’s GDP suffered a sharp decline by 6.17 percent in Q3 – the first time its economy recorded negative growth since 2000. This was a sharp contrast to 2020 when Vietnam managed to keep the pandemic at bay and with economic activities largely operating in normal capacity. But the Delta COVID variant incapacitated traditional strategies of containment. Nevertheless, things are looking up. Economic activity resumed in October as Vietnam opted for a ‘living with the pandemic’ approach. Government authorities also announced a phased plan to reopen the economy to ensure pandemic prevention policies are in line with mandates from health authorities. Vietnam’s Ministry of Planning and Investment (MPI) has targeted an annual average GDP growth rate of 6.5-7 percent during the 2021-2025 period. While the country suffered setbacks, AmCham has noted that Vietnam’s role in global supply chains is only expected to grow. The business chamber also noted that Vietnam remains an attractive investment destination, including for further relocations out of China. As with last year, Vietnam’s market fundamentals remain strong, and its economy appears resilient to overcome the recent disruption to production due to the pandemic. Vietnam has already fully vaccinated more than 50 percent of its population. Foreign investors remain bullish on Vietnam’s long-term prospects. Businesses remain confident though there are challenges regarding a shortage of labor force, border restrictions, and compliance issues. Doing Business in Vietnam 2022 covers the following:

Within these chapters, we discuss a range of different topics that affect doing business in Vietnam, including market entry considerations, investment models, key taxes and incentives for foreign companies, as well as upcoming accounting changes. Special focus is also given to Vietnam’s reopening measures and fiscal policies for the new year. Source: Asia Briefing |

★ LHD Law Firm - A reputable and professional business consulting unit in Vietnam

In the process of investing and doing business in Vietnam, investors may face many difficulties in terms of legal, language, culture, and market. Owning a team of lawyers who are fluent in many languages, have international consulting experience, and have a deep understanding of Vietnamese law, LHD Law Firm can confidently guide and support clients to carry out the entire investment procedure. invest, do business in Vietnam, and minimize possible legal risks.

With over 15 years of experience, LHD Law Firm has completed legal work for more than 6,800 projects for businesses and individuals from 32 countries around the world. We are currently a strategic partner in many projects, supporting many businesses to invest and do business in Vietnam to develop sustainably.

We currently provide the following services:

-

Advising on the conditions for establishing foreign-invested companies for investors according to specific business fields or investors' nationality;

-

Consulting the capital contribution ratio of foreign investors in Vietnam with Vietnamese law and WTO commitments;

-

Advising on choosing the right type of company for investors: limited liability company or joint stock company, head office address, capital, business lines, opening an account to transfer capital, the time limit for capital contribution;

-

Advising on conditions, guiding investors to prepare necessary documents to establish a foreign-invested company;

-

Consulting and drafting company establishment documents for foreign investors;

-

Representing investors to work with competent Vietnamese state agencies in the process of establishing enterprises for investors (Apply for Investment Registration Certificate, Business Registration Certificate, legal entity seal, seal sample announcement, procedures after company establishment, tax and accounting consulting services, profit transfer abroad, labor - insurance, issues related to ownership wisdom…;

-

Comprehensive advice on activities arising in the process of doing business in Vietnam for investors.

Hopefully, the above sharing will help foreign investors who intend to do business in Vietnam. If you have any doubts or problems, please contact LHD Law Firm immediately to get specific advice from legal experts.

0 comment