Open A Company In Vietnam For Foreigners

- 13/12/2022

Set up company in Vietnam → Guide by LHD Law Firm

CONTENT

CONTENT

CONTENT

CONTENT

Open a company in Vietnam for foreigners

There are a few ways to open a company in Vietnam for foreigners, but the most common is through an angel investor or venture capitalist. Other options include setting up an office in Vietnam and registering with the Vietnam Chamber of Commerce and Industry.

When opening a company in Vietnam

The most common way to open a company in Vietnam for foreigners is through an angel investor or venture capitalist. Other options include setting up an office in Vietnam and registering with the Vietnam Chamber of Commerce and Industry.

any in Vietnam, it is important to make sure you have the proper paperwork in place. You will need to file a Registration of Company with the Vietnam Chamber of Commerce and Industry, as well as a Corporate Identification Number (CIN).

Once the paperwork is complete, you will need to start planning your business. You should research the different business models in Vietnam and figure out what type of business you would like to start. You can also look into marketing and marketing strategies.

When starting a company in Vietnam, it is important to have a good marketing strategy in place. You should consider creating a website, setting up social media accounts, and creating marketing materials. You should also consider creating a marketing budget and planning your marketing efforts accordingly.

1. Research the business you want to start. Consider the type of business, the products or services you want to offer, the target market, and the competition.

2. Obtain the proper business licenses and permits. In Vietnam, you must have a business license to operate a company.

3. Register your company with the Vietnamese government. This includes completing a registration form, providing supporting documents, and paying the registration fee.

4. Open a corporate bank account. This will allow you to deposit funds and manage the financial transactions of your company.

5. Hire employees. You will need to obtain the proper work visas for your employees and register them with the government.

6. Comply with Vietnamese business laws. This includes filing annual reports, paying taxes, and following environmental and safety regulations.

If you're looking to open a business in Vietnam, it's important to understand the steps involved in the process, as well as the requirements, procedures, and costs. This guide will help you get started as a foreign investor.

To open a company in Vietnam, you will need to have the following:

-A minimum capital of VND 3,000,000,000

-A business registration certificate

-A business license

-An investment registration certificate

-A tax registration certificate

-A company seal

-A company charter

-A bank account

- Make sure you have a business license from your home country

- Make sure you have a valid passport

- Make sure you have a business visa

- Make sure you have a work permit

- Make sure you have a temporary residence card

- Make sure you have a health certificate

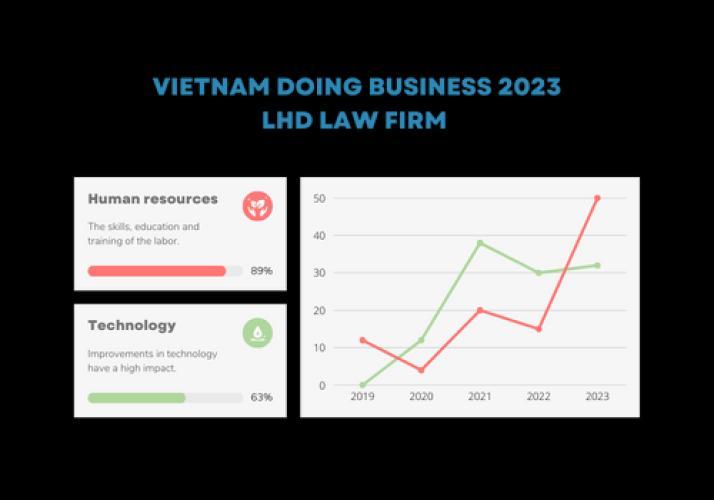

The business conditions are the current economic conditions that businesses are facing. This can include things like the interest rates, the amount of money that is available to businesses, the level of consumer confidence, and other factors.

Investment capital refers to the funds that are available to be invested in new or existing businesses. The capital can come from a variety of sources, including personal savings, loans from financial institutions, or investment from venture capitalists. The amount of capital available will often dictate the size and scope of the businesses that can be undertaken.

The business address is the address where the business is located. This is typically the address that is used for the business's mailing address, but it may also be the address that the business uses for its physical location. The business address can be either a physical address or a mailing address, but it is typically the address that is used for both.

A company is a legal entity that is typically made up of a group of people who come together to conduct business. The structure of a company can vary depending on the type of business it is involved in, the size of the company, and the location of the company. The most common type of company structure is the sole proprietorship, which is a company that is owned and operated by one person. Other common types of company structures include partnerships, limited liability companies, and corporations.

A legal representative is someone who has the legal authority to make decisions on behalf of another person.

There are a few required documents in order to apply for a passport. These include a passport application form, proof of U.S. citizenship, proof of identity, two passport photographs and the passport fee.

#1. The conditions under which a business operates. This can include things like the state of the economy, the availability of resources, competition, and other factors.

#2. The term "business conditions" is often used to refer to the overall state of the economy.

Vietnam is not an entirely open market for foreign investors, so it is important to consult with lawyers to understand all local conditions before starting a business there. The following activities should be easy for foreigners to do in Vietnam:

Bringing goods or services into a country from another country is called import. Export is the opposite. It is when a company sends goods or services to another country.

Wholesale distribution is the process of selling goods to retailers, businesses, or other organizations. It is the middleman between the manufacturer and the customer. Wholesale distributors typically buy products in large quantities at a discount from manufacturers and then sell them to customers in smaller quantities at a higher price.

Wholesale distribution is the process of selling goods to retailers, businesses, or other organizations. It is the middleman between the manufacturer and the customer. Wholesale distributors typically buy products from manufacturers in large quantities at a discount and then sell them to customers in smaller quantities at a higher price.

There are many different types of business consulting services out there. But how do you know which one is right for your business? And how do you find a reputable business consultant?

There are a few things you should keep in mind when looking for business consulting services. First, you need to make sure that the company you're considering is reputable and has a good track record. You can check out online reviews or ask around for recommendations.

Once you've found a few companies that you're interested in, you need to make sure they're a good fit for your business. To do this, you'll need to have a clear idea of what your goals are and what you need help with. You should also ask for quotes from each company so you can compare prices.

When you're ready to choose a business consultant, make sure you ask lots of questions and get everything in writing. This way, you can be sure you're getting the best possible service for your business.

Information technology (IT) is a critical part of any business today. IT services can help businesses improve their bottom line and increase their productivity. In order to get the most out of their IT services, businesses need to carefully select the right provider.

When choosing an IT services provider, businesses should consider a few key factors. First, they should make sure that the provider has a good reputation. Second, they should make sure that the provider offers a comprehensive suite of services. Finally, they should make sure that the provider is able to customize their services to meet the specific needs of the business.

By carefully selecting an IT services provider, businesses can reap the many benefits that these services can offer.

2. Investment capital refers to the money that is used to finance an investment. This can come from a variety of sources, including personal savings, loans, and venture capital.

Each company in Vietnam is required to declare and deposit an amount of capital.

There is no set amount of money that you are required to have in order to start a business. However, the licensing authority will look at how much money you have available to invest in your business and will make a decision based on that.

The more money you invest in a company, the longer your visa will be granted.

Vietnam offers an investor visa for those who are looking to invest in the country. There are certain capital requirements that must be met in order to be eligible for this visa.

#The Business Address is the address where the business is physically located. This is the address that will be used on all legal documents and correspondence. It is important to have a physical address for your business, even if you operate primarily online. The Business Address is also the address that will be used for business taxes.

3. The Business Address is the address where the business is physically located. This is the address that will be used on all legal documents and correspondence. It is important to have a physical address for your business, even if you operate primarily online. The Business Address is also the address that will be used for business taxes.

To be in compliance with article 38 of the Law on Investment 2020, your company must have a registered office and principal place of business in Vietnam.

The best place to register your company is usually the place where you'll be doing most of your business. You should always visit the site in person to make sure it's a good fit for your company.

#There are four main types of business structures in the United States: sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each type of structure has its own advantages and disadvantages.

#There are four primary types of business organization in the United States: sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each has its own benefits and drawbacks.

1. Joint Stock Company

2. Limited Liability Company

3. Partnership

There are three primary types of company structures that foreign investors can choose from when doing business in Vietnam: a joint stock company, a limited liability company, or a partnership.

There are three common company structures in Vietnam: sole proprietorship, limited liability company, and joint stock company.

A sole proprietorship is a business owned and operated by one person and is the simplest form of business organization.

A limited liability company (LLC) is a business structure in which the owners are not personally liable for the company's debts or liabilities.

A joint stock company (JSC) is a company that has both shareholders and directors. The shareholders elect the directors, who then manage the company.

There are many factors to consider when choosing which company structure to establish, including the number of investors and the management structure you require. LLCs are often the best fit for small and medium businesses due to their simple management structure and lower corporate compliance costs.

The tax regulations in Vietnam do not take into account the different structures of companies. This means that the tax treatment is the same for all companies, regardless of their structure.

Visit this site to learn more about the company structures of businesses in Vietnam.

The legal representative is the person who represents the company in court and is responsible for all legal matters. This person is usually a lawyer, but can also be a paralegal or legal assistant. The legal representative is responsible for drafting all legal documents, filing them with the court, and representing the company in court.

The legal representative is the individual who represents the company in legal matters and exercises the rights and obligations arising from the company’s transactions, according to Article 12 of the Enterprise Law 2020.

A company in Vietnam is not required to have a local legal representative, but it may be beneficial to do so. The legal representative may be given the title of Director, General Director, CEO, CFO, President, etc. This position can be helpful in ensuring that the company complies with local laws and regulations.

In order to complete your application, you'll need to gather a few documents. These may include your:

1. Social Security number

2. Birth certificate

3. Driver's license

4. Passport

5. Tax returns

6. Bank statements

7. Pay stubs

8. Mortgage or rental agreement

9. utility bills

10. Insurance policy

11. Military records (if applicable)

The foreign investors will be required to provide the documents listed below. The corporate investor's documents (e.g. company registration certificate) must also go through the legalization and notarization process.

An individual investor is a person who invests in stocks, bonds, and other securities on their own behalf, rather than on behalf of another person or institution. A corporate investor is a company that invests in stocks, bonds, and other securities on behalf of its shareholders.

In order to invest in a company, all investors must provide the company with their passport and a company registration certificate.

The authorized representative(s) of the Investor must provide a valid passport or ID card.

A bank account statement is a document that shows all the activity in your account over a specified period of time. This includes deposits, withdrawals, checks that have been processed, and any fees or interest that have been charged.

The company must have a balance in their account that is equal to or greater than the value of their declared capital. They must also have a financial statement from the past two years.

This is the lease contract and its legal documentation related to the business address. This includes the lease agreement, the business license, and the proof of insurance.

There are a few steps you need to follow in order to open a company in Vietnam. First, you need to find a good location for your business. Then, you need to register your company with the local government. Once your company is registered, you need to get a business license. Finally, you need to find appropriate office space and hire staff.

1. Come up with an idea

2. Choose a business structure

3. Register the company

4. Get a tax identification number

5. Open a business bank account

Before you can open a business, you need to have a place to do it. You can either buy or rent a commercial space, depending on your needs and budget. Make sure to choose a location that is convenient for your customers and easy to find.

Step 2. Get a Business License

After you have found a place for your business, you need to get a business license from the government. This will allow you to legally operate your business. You may need to fill out some paperwork and pay a fee to get your license.

Step 3. Register Your Business

Once you have your business license, you need to register your business with the government. This will give you a official business name and allow you to start operating. You will need to fill out some paperwork and pay a fee to register your business.

Step 4. Get Business Insurance

To protect your business, you need to get business insurance. This will help cover any damages or losses that your business may incur. You can get insurance from a variety of sources, such as the government or private companies.

Step 5. Hire Employees

If you plan to have any employees, you need to hire them. Make sure to do your research and find qualified employees that will be a good fit for your business. You will need to fill out some paperwork and pay taxes on your employees.

To apply for a job, you will need to have certain documents ready. These may include a resume, cover letter, work samples, and/or references. Review the job posting carefully to see what specific documents you will need to provide.

To apply for a job, you will need to have certain documents ready. These may include a resume, cover letter, work samples, and/or references. Review the job posting carefully to make sure you have all the required documents.

In order to register a company, you will need to fill out a form and pay a fee.

Now that you have a business address, you can open bank accounts in the name of your business. This will help you keep your personal and business finances separate. You may need to show your business registration documents and your business license when opening the account.

Some businesses require licences or permits in order to operate legally. If your business falls into this category, you'll need to apply for the relevant licences and permits before you can start operating. Depending on the type of business you're running, you may need to apply for multiple licences and permits.

First, you need to come up with a topic for your paper.

First, you will need to come up with a topic for your paper. This can be done by brainstorming potential ideas, or by looking for inspiration in sources such as books, articles, or websites. Once you have settled on a topic, you will need to narrow it down into a thesis statement. This statement should briefly summarize the main point of your paper.

The first step to starting your own business is to find a suitable location to rent. This location will be the base of operations for your business, so it is important to find a space that is comfortable and practical for you and your employees. Once you have found a suitable location, you will need to negotiate a lease with the landlord and sign the lease agreement.

To set up your business, you'll need to find an appropriate location for your company and sign a lease agreement with the landlord. After that, you'll need to ask the landlord for any relevant legal documents, like a certificate of land right use.

You will need to gather the required documents before you can begin the application process.

As your lawyer suggested, you will start by gathering all the necessary documentation, getting it notarized, and translating it into Vietnamese. The lawyer will prepare complete application forms that need your signature and stamp (if any).

To register a company, you will need to:

1. Choose a company name

2. Register with the Companies House

3. Get a company seal

4. Appoint directors

5. Create shareholders' agreements

6. Register for taxation

7. Open a corporate bank account

1) The first step is to take the input from the user in the form of a string. This input string is then converted into a list of characters.

2) The second step is to create a new empty list. This list will be used to store the characters in the input string that are not repeated.

3)The third step is to loop through the list of characters. For each character in the list, we check to see if it is already in the new list. If it is not, we add it to the new list. If it is, we do nothing.

4)The fourth and final step is to convert the new list back into a string and print it out.

It can take up to 15 working days to file for an Investment Registration Certificate.

It can take up to five working days to file for an Enterprise Registration Certificate

Once you have chosen and hired your legal team, they will be responsible for communicating and coordinating with local authorities to ensure that your company registration goes smoothly. Make sure to stay updated with your team's progress to avoid any surprises.

Opening a local bank account is a good way to store and manage your money while you are living in a new country. It can also help you to access local services and to build a relationship with a bank in your new country.

You will need to open at least 2 bank accounts for your company.

A D.I.C.A. can only be opened by a foreigner who is investing in Vietnam through one of the following investment channels:

- Setting up a new company

- Buying shares in an existing company

- Contributing capital to a company

- Investing in a project in Vietnam

A bank account that will be used to handle the company's daily activities, like paying contracts, salaries, and taxes.

If your business requires any licences or permits, you will need to apply for them at this stage.

1. Your Vietnam company must apply and obtain the required licenses or permits before performing any conditional business/industry.

You can expect to pay around $3,000 to open a company in Vietnam. This includes the cost of your business license, which is required for all businesses operating in the country. You will also need to register your business with the local government, which will cost an additional fee.

1. An item must have a description.

2. An item's description must be at least 10 characters long.

3. An item must have a minimum cost.

Your yearly registered address is the address of your coworking space membership.

The cost of renting an office space or factory is $970.

Our legal team will advise and help you form a company in Vietnam for a fee of $1,700.

After a company is incorporated, it needs to comply with various regulations. One of these is having a digital signature for a 3-year service

A company sign is a signboard that is used to advertise a company.

This is an invoice for $320 worth of value-added tax (VAT).

Compliance with accounting standards requires that businesses keep accurate records of their financial activities and submit accurate reports to tax authorities.

An annual audit is an examination of a company's financial statements and records to ensure they are accurate and compliant with laws and regulations. This process can be conducted by an external auditor, or an internal auditor.

A business visa is a visa that allows you to stay in a country for up to 12 months to conduct business activities. This type of visa may be required if you are planning to start a business in the country, invest in a business, or take part in business-related activities such as attending meetings or conferences. A work permit may also be required in some cases.

Work permits for foreign employees will cost $800.

The total cost for the first year of operation will be at least $5,290.

Approximately USD 5,290 is the minimum amount of money it would cost to set up and operate a company in Vietnam for the first year. The majority of these expenses go towards renting business premises, incorporation services, and post-incorporation compliance fees.

Vietnam is a great place to start a business. The cost of living is relatively low and there are plenty of opportunities to make money. However, there are a few things you need to consider before starting a business in Vietnam.

The first thing you need to do is research the market. You need to find out if there is a demand for your product or service. There are many ways to do this, including online research, talking to potential customers and conducting surveys.

Once you have done your market research, you need to figure out how much it will cost to start your business. This includes the cost of setting up a office, renting premises, buying equipment and hiring staff.

You also need to consider the cost of marketing and advertising your business. This can be a significant expense, especially if you are starting a business in a competitive market.

Finally, you need to make sure you are aware of the legal requirements for starting a business in Vietnam. This includes getting a business license and registering your company.

If you are planning to start a business in Vietnam, it is important to do your research and understand the costs involved. By doing this, you will be able to make an informed decision about whether or not starting a business in Vietnam is right for you.

LHD Law Firm is a company that specializes in helping foreign businesses open up and operate in Vietnam. They can help with all the paperwork and requirements needed to get your business up and running smoothly in Vietnam.

LHD Law Firm has extensive experience helping foreign investors set up businesses in Vietnam. We offer a full range of business legal services, including legal consulting, company registration, licensing, and visas. Contact us today to get started on setting up your Vietnam company.

Are you interested in forming a corporation?

LHD Law Firm can help you take the next step towards your dream business in Vietnam by requesting a proposal now.

No, you should not use local nominees to open a company in Vietnam on your behalf. This is because it is illegal and can result in serious consequences.

The meaning of the word "depended" is that it is affected by something else.

The benefits of having a Local Nominee is that it allows You to own 100% of your company, while still being in compliance with Vietnamese laws. Not only that, but it also gives You some legal protections – such as the right to own property and the right to a Vietnamese work visa.

However, there are also some downsides to having a Local Nominee. For one, You will have to give up some control of your company to the Local Nominee. Additionally, the Local Nominee will be held liable for any legal issues that may arise from the company.

1. The foreign investor does not need to go through the complicated process of setting up a new company.

2. The foreign investor does not need to deal with the Vietnamese bureaucracy.

3. The foreign investor can avoid some of the restrictions that are placed on foreign ownership of businesses in Vietnam.

More benefits come with owning a local company as opposed to a foreign one- such as cheaper and faster setup and operation.

A local company is allowed to bypass certain restrictions on foreign investment, so long as they apply for the proper licenses and permits.

This option is also risky, but to a much greater degree.

According to the law, the Vietnamese partner is the real company's owner/shareholder and has the authority to decide all corporate matters of the local company, such as accessing the bank company account, enjoying profits, and sale and purchase of the company's assets. If the Vietnamese partner act inappropriately and against the benefits of the actual foreign owner, the local company business activities can be delayed, and the foreign owner may suffer major damages.

This means that if there is a disagreement between the Vietnamese partner and the foreign owner, the foreign owner will not be protected by law, even if there is an agreement between the parties.

An enormous amount of trust is placed in this Vietnamese Nominee, meaning extreme trust built from years of business collaboration in the past. However, when profits are bad, this "nominee director" could close the accounts and withdraw the remaining funds. Similarly, if profits are great, this nominee director could withdraw funds for their own personal benefit.

It typically takes around two to three weeks to incorporate a Vietnam company.

It will take a minimum of 20 working days to finish the company registration process and obtain both the IRC and the ERC. This is in contrast to other countries where the company formation process is much faster.

No, you do not need a visa to set up a company in Vietnam.

You cannot work in Vietnam without a visa, even if you are the owner or manager of a Vietnamese company. If you plan to travel to Vietnam frequently or live in Vietnam and work for your company, you can apply for a long-term visa sponsored by your Vietnamese company.

The tax rate in Vietnam can vary depending on the type of business and income, but the corporate income tax rate is generally 20%.

This is an overview of tax

What are the taxation policies in Vietnam?

In Vietnam, taxation is handled at both the national and local levels. The Ministry of Finance is in charge of collecting taxes and managing the country's finances, while each province has its own tax department responsible for collecting taxes from businesses and individuals within its jurisdiction.

The Vietnamese tax system is based on a progressive income tax, meaning that those who earn more money are taxed at a higher rate than those who earn less. The personal income tax rate ranges from 5% to 35%, and the corporate income tax rate is 20%. Other taxes include value-added tax (VAT), land use tax, and import and export duties.

Vietnam has double taxation agreements (DTAs) with a number of countries, which means that Vietnamese taxpayers who have income from abroad may be able to avoid paying taxes twice on the same income.

0 comment