Vietnam Company Registration: Steps, Costs, and Requirements Explained

- 16/08/2024

How To Register Company In Vietnam As A Foreigners [Process and Requirements]

CONTENT

CONTENT

CONTENT

CONTENT

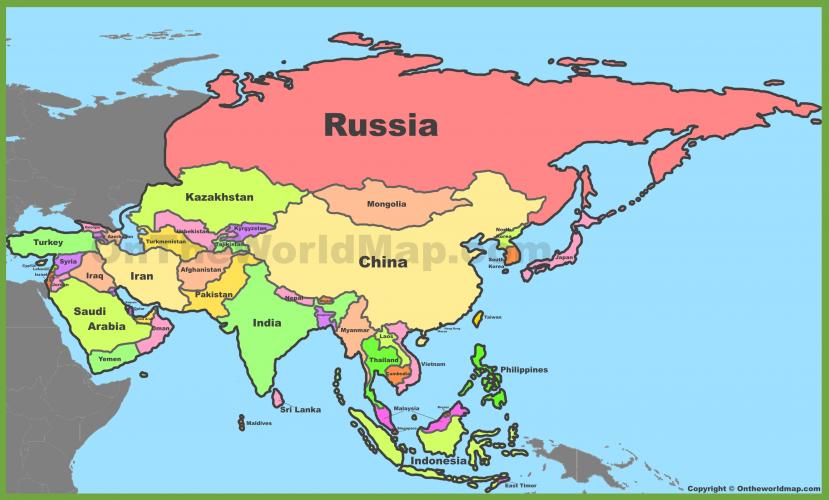

Vietnam's rapidly growing economy and strategic location in Southeast Asia have made it an attractive destination for foreign investors. Establishing a business presence in Vietnam can be a lucrative opportunity, but navigating the registration process can be complex. This comprehensive guide will walk you through the essential steps, options, and considerations for registering a company in Vietnam as a foreign investor.

Understanding Company Registration Options in Vietnam

When it comes to establishing a business presence in Vietnam, foreign investors have several options to choose from. Each type of company structure has its own advantages, limitations, and registration requirements. Let's explore the three main types of company structures available for foreign investors in

Vietnam Company Registration: A Guide for Foreign Investors

Starting a business in Vietnam can be a rewarding venture, but it requires navigating the local legal and regulatory landscape. This guide outlines the key steps involved in registering a company in Vietnam.

1. Determine the Appropriate Business Structure:

- Limited Liability Company (LLC): The most common choice for foreign investors, offering liability protection and flexibility.

- Joint Stock Company: Suitable for larger companies with multiple shareholders.

- Branch Office: For companies already established abroad, operating in Vietnam without forming a separate legal entity.

- Representative Office: Represents the foreign parent company in Vietnam but cannot conduct business activities.

2. Choose Your Business Name:

- The name must be in Vietnamese and must be available for registration.

- It must not be identical or too similar to existing registered companies.

- Consider using a name that is memorable, relevant to your business, and conveys your brand message.

3. Prepare Required Documents:

- Memorandum of Association (MoA): Outlines the company's purpose, objectives, and capital structure.

- Articles of Association (AoA): Defines the company's internal governance structure, including shareholder rights and duties.

- Business Plan: Provides details about the company's operations, market analysis, financial projections, and management team.

- Personal Identification Documents of Shareholders and Directors: Passport copies and visa information are often required.

- Proof of Registered Address (for the company and shareholders): A lease agreement or property ownership document is typically needed.

4. Obtain Necessary Approvals:

- Investment Registration Certificate: Required for foreign investors, outlining the investment scope and project details.

- Business Registration Certificate: Issued by the Department of Planning and Investment (DPI) after reviewing the submitted documents.

- Tax Registration Certificate: Obtained from the General Department of Taxation.

5. Complete Statutory Compliance:

- Company Seal: The official seal of the company must be registered with the authorities.

- Tax Compliance: Businesses must comply with Vietnam's tax laws, including paying corporate income tax, value-added tax (VAT), and other relevant taxes.

- Labor Laws: The company must comply with labor regulations regarding employment contracts, wages, and working conditions.

Important Points to Consider:

- Language Requirements: All documents must be submitted in Vietnamese. Translation services are available.

- Professional Assistance: It is highly recommended to engage a legal and accounting professional specializing in Vietnamese business registration.

- Timeframe: The entire process can take several weeks to months, depending on the complexity of the business and the approval process.

Conclusion:

Registering a company in Vietnam involves a multitude of steps and requires careful attention to detail. Thorough preparation, expert advice, and adherence to the legal requirements are crucial for a successful and compliant business setup. Vietnam:

Representative Office: A Gateway to Market Research

A Representative Office (RO) is an ideal choice for foreign companies looking to conduct market research and explore business opportunities in Vietnam without engaging in direct income-generating activities.

Key Features of Representative Offices:

- Perfect for foreign companies conducting market research

- No income-generating activities allowed

- One owner, 100% foreign-owned

- The foreign company must have been operating for more than one year

- Processing time: 3-4 weeks

Representative Offices serve as a valuable tool for foreign companies to establish a presence in Vietnam, gather market intelligence, and build relationships with potential partners and customers. While ROs cannot engage in profit-making activities, they provide a low-risk entry point for companies to assess the Vietnamese market before committing to a full-fledged business operation.

Advantages of Representative Offices:

- Low setup and maintenance costs

- Simplified registration process

- No requirement for minimum capital investment

- Ability to hire both local and foreign employees

Limitations of Representative Offices:

- Cannot generate revenue or sign contracts

- Limited scope of activities

- Cannot issue invoices or collect payments

Limited Liability Company: The Popular Choice for Foreign Investors

A Limited Liability Company (LLC) is the most widely used structure for foreign investors establishing operations in Vietnam. This type of company offers flexibility and the ability to conduct a wide range of business activities.

Key Features of Limited Liability Companies:

- Conduct registered business activities

- One or more company owners/members

- Partly or wholly foreign ownership

- Cannot issue shares

- Processing time: 3-4 weeks

LLCs provide a balance between operational flexibility and liability protection, making them an attractive option for many foreign investors. They can be established with either a single member (Single-member LLC) or multiple members (Multi-member LLC).

Advantages of Limited Liability Companies:

- Limited liability protection for owners

- Flexibility in ownership structure

- Ability to conduct a wide range of business activities

- Relatively straightforward management structure

Considerations for Limited Liability Companies:

- Minimum capital requirements may apply depending on the industry

- Transfer of ownership can be more complex compared to Joint Stock Companies

- Cannot raise capital through public offerings

Joint Stock Company: For Complex Corporate Structures

A Joint Stock Company (JSC) is ideal for foreign investors who require complex corporate structures or plan to list on the stock exchange in the future.

Key Features of Joint Stock Companies:

- Conduct registered business activities

- At least 3 shareholders

- Partly or wholly foreign ownership

- Can issue shares

- Processing time: 3-4 weeks

Joint Stock Companies offer the most flexibility in terms of capital raising and ownership structure. They are suitable for large-scale projects or businesses that anticipate future expansion and public listing.

Advantages of Joint Stock Companies:

- Ability to issue shares and raise capital through public offerings

- Easier transfer of ownership through share transfers

- Suitable for complex ownership structures and large-scale projects

- Potential for listing on stock exchanges

Considerations for Joint Stock Companies:

- More complex management structure, including a board of directors

- Higher setup and maintenance costs compared to LLCs

- Stricter regulatory requirements and reporting obligations

The Step-by-Step Process of Registering a Foreign-Owned Company in Vietnam

Registering a foreign-owned company in Vietnam typically takes less than 30 days, regardless of the selected company type. The process involves several key steps that foreign investors must follow to establish their business legally in the country.

Step 1: Obtaining an Investment Registration Certificate (IRC)

The first crucial step in setting up a foreign-owned company in Vietnam is obtaining an Investment Registration Certificate (IRC) from the provincial Department of Planning and Investment (DPI) or a similar state agency.

What is an Investment Registration Certificate?

An IRC is a document that certifies the Vietnamese government's approval of a foreign investment project. It outlines the scope of the investment, the investors involved, and the project's implementation timeline.

The IRC Application Process:

- Prepare the required documents, including:

- Application form for the IRC

- Copy of the foreign investor's passport or business registration certificate

- Investment proposal detailing the project's objectives, scale, and location

- Financial capacity proof of the foreign investor

- Environmental impact assessment (if required)

- Submit the application to the relevant authority (usually the DPI)

- Attend meetings or provide additional information if requested by the authorities

- Receive the IRC upon approval (usually within 2-3 weeks)

Importance of the IRC:

The IRC is a fundamental document that allows foreign investors to proceed with company registration and other necessary steps to establish their business in Vietnam. It demonstrates that the investment project has been approved by the Vietnamese government and complies with relevant regulations.

Step 2: Applying for an Enterprise Registration Certificate (ERC)

Once the IRC is obtained, the next step is to apply for an Enterprise Registration Certificate (ERC), which is similar to a certificate of incorporation in many jurisdictions.

What is an Enterprise Registration Certificate?

The ERC is an official document that recognizes the legal existence of a company in Vietnam. It contains essential information about the company, including its name, registration number, address, legal representative, and registered capital.

The ERC Application Process:

- Prepare the required documents, including:

- Application form for company registration

- The company's charter

- List of founding shareholders or members

- Copies of personal identification documents of the company's legal representative and shareholders/members

- Copy of the IRC

- Submit the application to the Business Registration Office

- Pay the registration fee

- Receive the ERC (usually within 1 week)

Significance of the ERC:

The ERC is a crucial document that allows the company to operate legally in Vietnam. It serves as proof of the company's existence and is required for various business activities, such as opening bank accounts, signing contracts, and obtaining additional licenses or permits.

Step 3: Post-Licensing Tasks

After obtaining the ERC, several important post-licensing tasks must be completed to ensure the company is fully operational and compliant with Vietnamese regulations.

Essential Post-Licensing Tasks:

- Company Seal Creation:

- Design and order a company seal from an authorized seal maker

- Register the seal with the relevant authorities

- Initial Tax Registration:

- Register for tax codes and obtain a tax registration certificate

- Set up the company's tax payment and reporting system

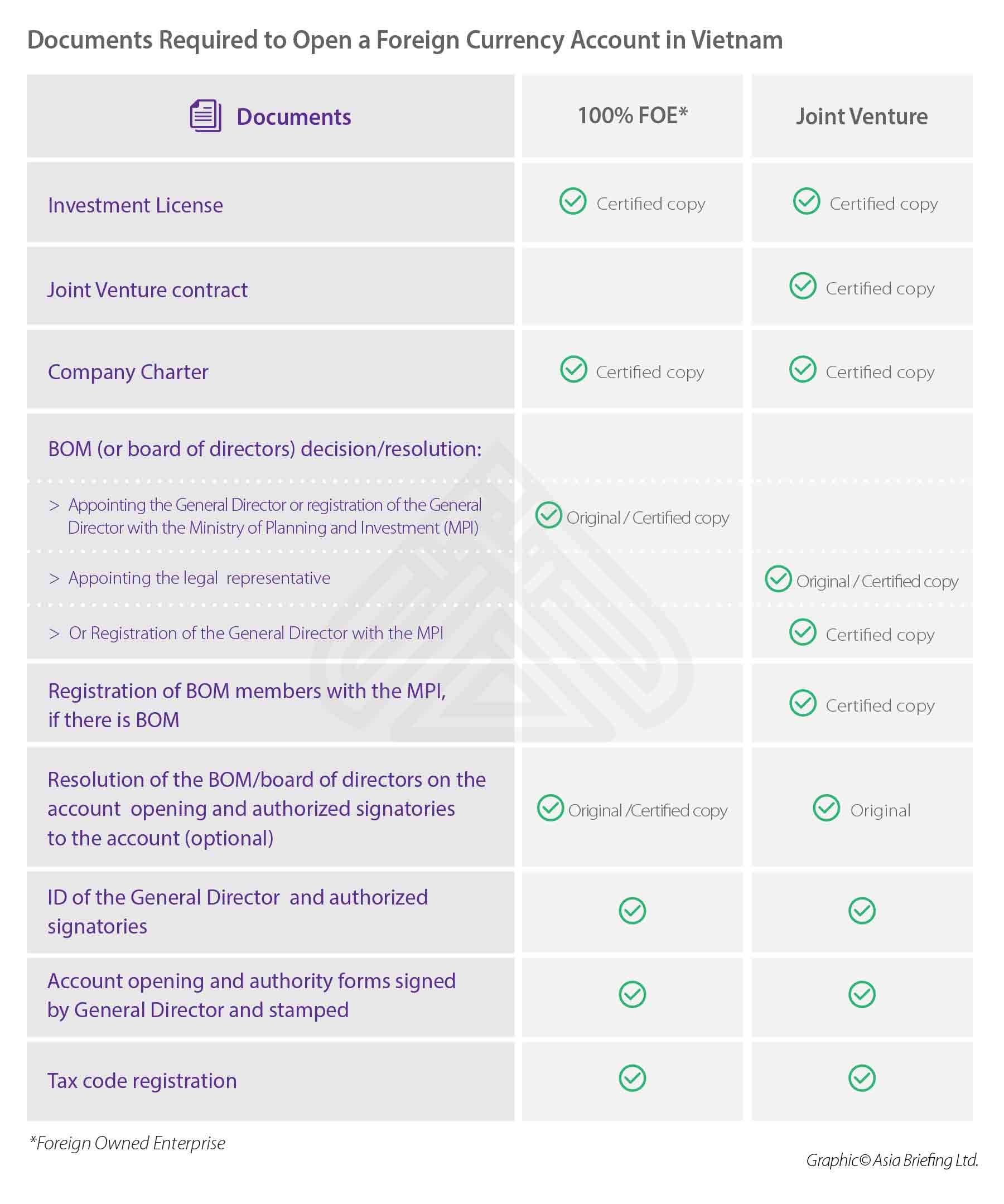

- Bank Account Opening:

- Choose a bank and prepare the required documents

- Open both VND and foreign currency accounts as needed

- Business License Tax Payment:

- Pay the annual business license tax based on the company's registered capital

- Labor Registration:

- Register the company with the local labor department

- Set up social insurance, health insurance, and unemployment insurance accounts for employees

- Accounting System Setup:

- Establish an accounting system that complies with Vietnamese Accounting Standards

- Appoint a chief accountant or outsource accounting services

Importance of Post-Licensing Tasks:

Completing these post-licensing tasks is crucial for ensuring that the company can operate smoothly and remain compliant with Vietnamese laws and regulations. Failure to complete these tasks in a timely manner can result in penalties or difficulties in conducting business activities.

Comprehensive Company Formation Services in Vietnam

Navigating the complex process of company registration in Vietnam can be challenging for foreign investors. Professional services providers, such as LHD Law Firm, offer comprehensive company formation packages to simplify the process and ensure compliance with local regulations.

Vietnam Company Formation Package

A typical company formation package includes essential services to help foreign investors establish their business presence in Vietnam efficiently.

Key Components of a Company Formation Package:

- Vietnam Company Formation Assistance:

- Guidance on choosing the appropriate company structure

- Preparation and submission of all necessary documents

- Investment Registration Certificate (IRC) Application:

- Assistance in preparing the investment proposal

- Liaison with relevant authorities during the IRC application process

- Company Name Availability Check:

- Conducting searches to ensure the proposed company name is available and compliant with local regulations

- Charter/Memorandum and Articles of Association:

- Drafting and reviewing the company's founding documents to ensure compliance with Vietnamese law and the investors' requirements

- Share Certificates Issuance:

- Preparation and issuance of share certificates for shareholders (applicable for Joint Stock Companies)

- Company Stamp Creation:

- Design and ordering of the company seal

- Registration of the seal with relevant authorities

- Initial Tax Registration:

- Assistance in obtaining tax codes and completing initial tax registration procedures

- Bank Account Opening Support:

- Guidance on choosing suitable banks

- Assistance in preparing documents and liaising with banks to open corporate accounts

- Virtual Office Service:

- Provision of a registered business address and mail handling services

Business Maintenance Services

In addition to company formation, many service providers offer ongoing business maintenance support to help foreign-owned companies operate smoothly in Vietnam.

Essential Business Maintenance Services:

- Tax Computation and Filing Support:

- Calculation of various taxes (e.g., corporate income tax, value-added tax)

- Preparation and submission of tax returns

- Preparation of Periodical Tax Returns (Unaudited):

- Compilation of financial data

- Preparation of regular tax reports as required by Vietnamese tax authorities

- Social Insurance-related Services:

- Management of social insurance, health insurance, and unemployment insurance contributions

- Liaison with social insurance authorities

- Corporate Management Consulting:

- Advice on corporate governance issues

- Guidance on compliance with local regulations

- Business-in-Vietnam Support Services:

- Ongoing support for various business operations

- Assistance in navigating local business practices and regulations

- Post-Vietnam Company Registration Consultancy:

- Advice on expansion strategies

- Guidance on obtaining additional licenses or permits as needed

- Vietnam Nominee Directors/Shareholders Services:

- Provision of local nominee directors or shareholders if required

- Ensuring compliance with local ownership requirements

- Payroll Services:

- Calculation and processing of employee salaries

- Management of payroll taxes and social insurance contributions

- IP & Trademark Registration:

- Assistance in protecting intellectual property rights in Vietnam

- Guidance on trademark registration procedures

Additional One-off Services for Company Setup and Operation

In addition to comprehensive company formation and maintenance packages, foreign investors often require specific one-off services to address particular needs or comply with certain regulations. Many service providers offer these additional services to support various aspects of business operations in Vietnam.

Virtual Office Services

Virtual office services provide businesses with a professional address and mail handling capabilities without the need for physical office space.

Key Features of Virtual Office Services:

- Prestigious business address in a prime location

- Mail receipt and forwarding

- Call answering and message taking (optional)

- Access to meeting rooms or co-working spaces (as needed)

Benefits of Virtual Office Services:

- Cost-effective alternative to renting physical office space

- Enhances company image with a professional address

- Provides flexibility for businesses in their early stages or those with remote teams

Company Stamp and Digital Signature Token

Company stamps and digital signature tokens are essential tools for authenticating documents and conducting official business in Vietnam.

Company Stamp:

- Official seal used to validate company documents

- Required for most official transactions and contracts

Digital Signature Token:

- Secure USB device for electronically signing documents

- Valid for 3 years

- Enhances document security and streamlines digital transactions

E-VAT Invoices

Electronic VAT invoices are becoming increasingly common in Vietnam, offering businesses a more efficient way to manage their invoicing processes.

E-VAT Invoice Package:

- Typically includes 300 electronic VAT invoices

- Compliant with Vietnamese tax regulations

- Streamlines invoicing and record-keeping processes

Nominee Legal Representative Services

A nominee legal representative can act as a local expert and trusted intermediary for foreign businesses operating in Vietnam.

Key Aspects of Nominee Legal Representative Services:

- Provides a local presence for the company

- Assists in navigating local regulations and business practices

- Can sign certain documents on behalf of the company

When to Consider a Nominee Legal Representative:

- When local regulations require a Vietnamese citizen as a legal representative

- To facilitate smoother interactions with local authorities and partners

- For companies in the early stages of establishing their presence in Vietnam

Work Permit and Temporary Residence Card Services

Foreign employees working in Vietnam require proper documentation to legally reside and work in the country.

Work Permit Services:

- Assistance in preparing and submitting work permit applications

- Liaison with labor authorities

- Guidance on meeting work permit requirements

Temporary Residence Card Services:

- Support in applying for temporary residence cards for foreign employees and their dependents

- Assistance with document preparation and submission

- Guidance on visa and immigration regulations

Importance of Professional Support for Company Registration and Operation

Navigating the complexities of company registration and operation in Vietnam can be challenging for foreign investors. Engaging professional services providers offers several advantages:

- Expertise in local regulations and procedures

- Time and cost savings through efficient processing

- Reduced risk of errors or non-compliance

- Access to a network of local contacts and resources

- Ongoing support for various aspects of business operations

By leveraging these professional services, foreign investors can focus on their core business activities while ensuring compliance with Vietnamese laws and regulations.

LHD Law Firm: A Trusted Partner for Vietnam Company Registration

LHD Law Firm has established itself as a reliable and efficient partner for foreign investors looking to establish and maintain their business presence in Vietnam. With a track record of assisting over 1,000 clients in incorporating businesses, LHD Law Firm offers a comprehensive range of services tailored to meet the diverse needs of foreign investors.

LHD Law Firm Distinctive Approach

LHD Law Firm stands out in the market due to its client-centric approach and commitment to excellence in legal and business services.

Key Aspects of LHD Law Firm Approach:

- Personalized Service:

- Tailored solutions to meet each client's specific needs

- Direct communication with experienced lawyers and advisors

- Efficiency and Timeliness:

- Streamlined processes to ensure quick turnaround times

- Proactive approach to anticipate and address potential issues

- Comprehensive Support:

- End-to-end assistance from company registration to ongoing business maintenance

- Access to a wide range of specialized services

- Local Expertise with a Global Perspective:

- In-depth knowledge of Vietnamese laws and regulations

- Understanding of international business practices and standards

- Transparent Pricing:

- Clear fee structures with no hidden costs

- Competitive rates for high-quality services

Leadership Team at LHD Law Firm

The success of LHD Law Firm is driven by its experienced and diverse leadership team, each bringing unique expertise to support foreign investors in Vietnam.

Conclusion

Registering a company in Vietnam as a foreign investor can be a complex process, but with the right guidance and support, it can be navigated successfully. Understanding the different company structures available, the step-by-step registration process, and the various services offered by professional firms like LHD Law Firm can greatly simplify the journey.

By choosing the appropriate company structure, carefully following the registration steps, and leveraging professional services, foreign investors can establish a strong foundation for their business operations in Vietnam. As the country continues to attract foreign investment and develop its economy, those who enter the market with a clear understanding of the legal and regulatory landscape will be well-positioned for success.

Remember that while this guide provides a comprehensive overview, each business situation is unique. It's always advisable to consult with legal and business experts familiar with the latest regulations and practices in Vietnam to ensure a smooth and compliant company registration process.

0 comment