Legal Guide: Establishing Companies In Vietnam – LLC Vs JSC Decision

- 01/12/2025

Order Now! Vietnam company Formation [Virtual Office Space, Set-up company, Tax Advice, Legal Advice] How to proceed?

CONTENT

CONTENT

CONTENT

CONTENT

As a foreign investor looking to do business in Vietnam, you’ll need to make several crucial decisions. One of the first choices is determining the type of company that best suits your business. Let’s explore the two primary options: Limited Liability Company (LLC) and Joint Stock Company (JSC).

-

One Member LLC (Công Ty TNHH Một Thành Viên):

- Ownership: Owned by an organization or an individual member (the “Company Owner”).

- Liability: The Company Owner is liable for debts up to the amount of the charter capital.

- Features:

- Autonomy for the Company Owner in decision-making (e.g., amending the charter, appointing directors, enjoying profits).

- Simpler management structure: President and (General) Director or Members’ Council and (General) Director.

-

Multi-Member LLC (Công Ty TNHH Hai Thành Viên Trở Lên):

- Ownership: Owned by 2 to 50 members (organizations and/or individuals).

- Liability: Members are liable up to their contributed or committed capital.

- Features:

- Members can transfer capital contributions.

- Priority rights for current members.

- Capital raising options: increasing member contributions, new members, or issuing bonds.

- Simpler management structure: Members’ Council, President of the Members’ Council, and (General) Director.

-

Joint Stock Company (Công Ty Cổ Phần):

- Ownership: Shares held by three or more shareholders (organizations and/or individuals).

- Features:

- More complex structure due to shares.

- Suitable for larger companies aiming for stock exchange listing.

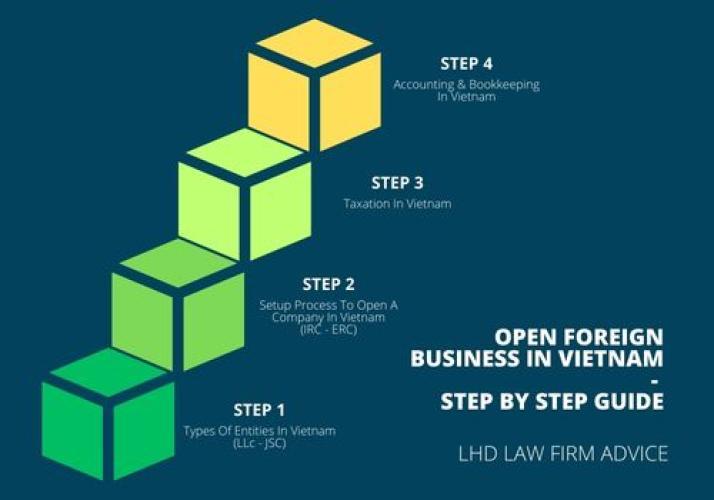

Setting Up an LLC or JSC in Vietnam (8 Steps):

- Decide on your business scope.

- Rent a business location.

- Select a company type (LLC or JSC).

- Choose a company name and capital structure.

- Apply for an Investment Registration Certificate.

- Apply for an Enterprise Registration Certificate.

- Open business bank accounts.

Remember, each type has its pros and cons. Consider your business goals and consult legal experts to make an informed decision. 🌟

Steps to work with LHD Law Firm

Step 1: Get Legal Advice English - Vietnamese

Meet with an attorney. We get legal advice on the type of business best suited to your situation.

Step 2: Find office space and legal representation for your business (if there is no available LHD office)

Then find an office space so that your business not only has a place of business, but also a specific office address required by the government to apply for a business license. If you are not the legal representative for your business, you need to find a trusted partner.

Step 3: Apply for a business license (IRC, ERC or BL)

Prepare all the necessary documents and make sure that you meet all the necessary requirements before applying for a business license. Expect a 15-day waiting period for a Vietnamese-owned company and a 60-day waiting period for a foreign company.

Step 4: Legal and tax advice for foreign companies after establishment

Running your Vietnamese business now has the ability to hire employees and enter into business contracts. There are several things you need to do, such as obtaining your company seal, applying for a tax identification number, opening a company bank account, and publicly announcing your incorporation. Periodic duties include employee tax, accounting report and insurance payments.

(In addition to legal advice, we also provide accounting services for companies with foreign capital for these companies)

☑ Why Choose LHD Law Firm

Everything we do at LHD Law Firm is focused on assisting your business through our investment law expertise and local business experience in Vietnam.

So that your enterprise can grow and expand quickly and avoiding the costly traps that many start-up investors fall into at the hands of unscrupulous lawyers and agents.

How we accomplish this.

We offer the best investment legal service in Vietnam, as well as a wide choice of INDIVIDUAL AND ECONOMIC EFFECTIVE SOLUTIONS for starting a business in Vietnam or managing an existing one.

What we can do ...

→ Senior lawyer LAW FIRM

Lawyer: Thanh Thuy (email: all@lhdfirm.com)

→ Lawyer specializing in advising on setting up foreign capital companies in Ho Chi Minh City

She graduated with a master’s degree in Commercial Law - City Law University of Ho Chi Minh City.

Consultancy language: English and Vietnamese

She is as one of the top 20 lawyers in Vietnam, highly rated by Legal500 and Hg.org → specializes in foreign investment, having realized more than 6800 projects in 15 years...

Lawyer: Phuong Khanh (email: hanoi@lhdfirm.com)

→ Lawyer specializing in advising on setting up foreign capital companies in Hanoi

She has a master's degree in Commercial Law from Hanoi Law University.

The language of consultation is English and Vietnamese

In order to seek further advice or request service Setup company in Vietnam, Contract us by →

0 comment