Joint- Stock Company (Jsc) In Viet Nam

- 01/01/1970

A joint-stock company is established through a subscription for shares in the company. Under Vietnamese law, only JSCs are permitted to issue shares to the public and may be listed on stock exchanges. The charter capital of a JSC is divided into shares, and each shareholder holds shares corresponding to the amount of capital contributed to the company. JSCs may either be 100% foreign-owned or may take the form of a joint venture between both foreign and domestic investors.

Investment Capital Requirements

A JSC must have a minimum of three shareholders, with no maximum. Shareholders are generally free to assign their shares to other persons, except in a few cases where restrictions exist.

A JSC’s charter capital equals the the aggregate value of the issued shares that the founding shareholders and the other shareholders have subscribed and recorded in the charter of the JSC.

Management

A JSC’s governance structure comprises of a General Meeting of shareholders, the board of management, the chairman of the board of management and the general director. A Board of Supervisors is also required where the JSC has more than 11 individual shareholders, or if a corporate shareholder holds more than 50% of the shares of the joint-stock company.

The GSM is the highest decision-making body of a JSC, while the Board of Management manages the day to day operations of the JSC. The BOM is required to have at least 3 members, with a maximum of 11. The number of members of the BOM who must reside permanently in Vietnam is stipulated in the JSC’s charter.

Accounting /auditing requirements

Similar to the LLC, JSCs are also required to prepare and submit audited financial statements to the appropriate authorities within ninety days from the end of the financial year.

Steps for Incorporation

Incorporation in Vietnam is generally considered a lengthy and bureaucratic process.

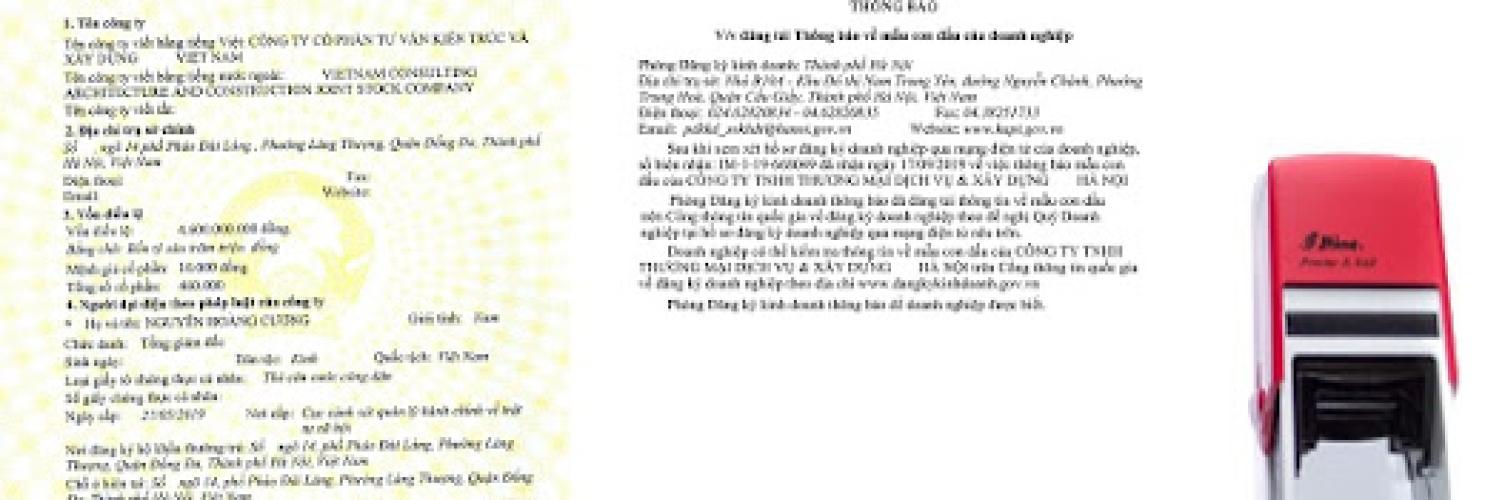

Step 1: Check the proposed company name; obtain a business registration certificate as well as a tax registration certificate from the local business registration office under the Department of Planning and Investment

The first step in the incorporation of a Vietnamese entity is to submit the relevant documents in accordance with Government Decree 43/2010/ND-CP (15 April 2010) on enterprise registration, as amended by Government Decree 05/2013/ND-CP (9 January 2013) (“Decree 43”). Provided the application file for enterprise registration fully satisfies the conditions for issuance of an enterprise registration certificate, information about that file shall be transferred to the database of the Department General of Taxation (Ministry of Finance). The Department General of Taxation will then create a unique enterprise code number and transfer it to the national database within two working days from the date of receipt of information from the national database of information. The provincial business registration office will then issue it to the enterprise. This code number is both the business registration code number and the tax code number of that enterprise

Send comment

Others Post

+68889+

Happy Client's

+16889+

Projects Done

+39+

Employees

3+

Office Locations

0 comment