Setting Up A Foreign Company In Vietnam

- 09/04/2020

It is not easy to create a company in Viet Nam although registration procedures have been simplified by authorities. If you are not well-prepared, you cannot avoid problems when establishing and running business. Following are some basic steps to set up business in Vietnam that may help you.

Step 1: Information preparation

This step helps you reduce errors and lessen the time you spend on later registration process. There are some issues needed to consider before you set up company in Vietnam.

Choose the type of business entity. According to the Law on Enterprises, there are four common types of business entities at present: private enterprises, joint stock companies, partnerships, limited liability companies (multi-member limited liability companies and single-member limited liability companies). This decision plays an important role in making or breaking your business ideas in practice. Therefore, try consulting experts before you make decision. The number of members (shareholders) varies according to the kind of business. Based on that number, company owners prepare notarized copies of IDs or visas.

Choose the name for your company. The name should be short, easy to remember and pronounce. It is not allowed to resemble other companies’ names which are available. Learn more information about available companies’ names at “National business registration portal”.

In addition to type of business entity and company name, other issues you need to prepare carefully before you create a company in Viet Nam are: choosing the office place, determining authorized capital for your business, selecting a title for company’s representative in law and choosing a legal industry to register.

Step 2: Registration process

After having prepared all the information needed to set up company in Vietnam, you can initiate to compile documents in accordance with Article 20 of Government Decree No. 43/2010/ND-CP (15 April 2010) on enterprise registration. Then, submit those documents at local business registration office (Article 25 of Decree 43). Submission can be done by the representative in law or an authorized representative as long as you have a power of attorney. If your application files are approved, you will receive business registration certificate after 5 working days.

Step 3: Make a company seal

Making a company seal is one of important steps when you set up business in Vietnam. Bring a copy of business registration certificate to seal-maker agency to make a stamp for your company. Then, the stamp will be sent to local police to verify and return to your company. Remember to bring along business registration certificate (original) and ID when you come to police station to get the stamp.

Step 4: Post-registration procedures

There are still several procedures needed to complete after having business registration certificate if you want to create a company in Viet Nam successfully.

Register tax reports not only at local tax office as the time required but also online through digital signature service in accordance with Law No. 21/2012/QH13 on amending and supplementing a number of articles of the law on tax administration.

“Publish in the network of information on enterprises of the business registration body or a written or electronic newspaper” (Article 28 of Law on Enterprises)

Submit reports and pay business license tax (form 01/MBAI enclosed with Circular No. 156/2013/TT-BTC dated 06 Nov 2013 of the Ministry of Finance).

Lodge notification to apply VAT calculation methods (form 06/MBAI enclosed with Circular No. 156/2013/TT-BTC dated 06 Nov 2013 of the Ministry of Finance)

Buy, create, self-printed invoices in accordance with Circular No. 39/2014/TT-BTC dated 01 June 2014.

If you have any questions, do not hesitate to contact our LHD Law Firm for new businesses.

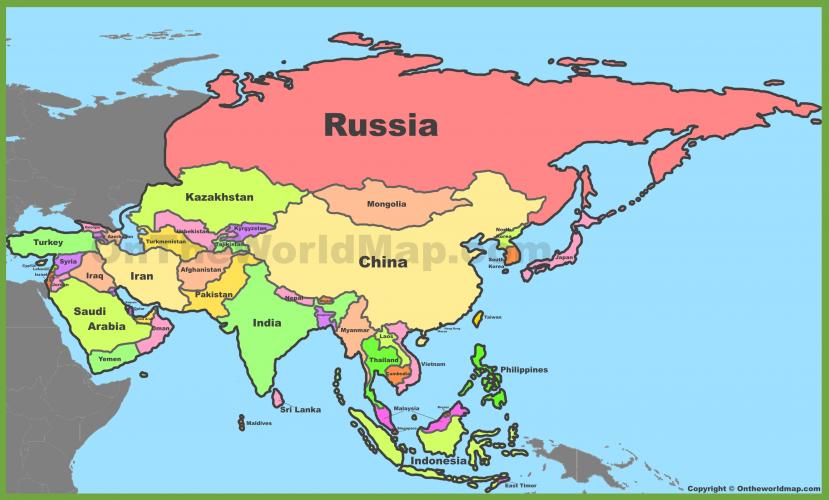

Setup a company 100% foreign-owned companies conducted by investors has always been subject to quite rigorous adjustments of investment and business laws.

In recent years, along with the non-stop development of our country’s economy and society, the number of foreign investors investing and building business in Vietnam is more and more increased. Establishing 100% foreign-owned capital companies has become popular business. With its unique characterization, establishing a company with 100% foreign-owned capital has always subject to quite rigorous adjustment of investment and business laws.

Register investment policy prior to Setup a company 100% foreign-owned companies

Before carrying out setting up a 100% foreign-owned company, investors must apply for an Investment Registration Certificate at an agency of business registration. In some cases, investors must register its investment policy with a provincial People's Committee.

Required documents include:

- A request for implementation of the investment project;

- A copy of ID card, passport, or certificate of business registration, or other equivalent document;

- A proposal of project investment: investors’ names, investment objectives, scale, capital and capital mobilization plan, location, duration, impact assessment, report on socio-economic efficiency, etc.

- A copy of one of the following documents: financial statement within the last two years; commitment of financial support from its parent company or a financial institution; guarantee of financial capability; documents proving capital capability;

- Demand for land use;

- Explanation on technology application, including name of such technology;

- BCC contract in case of implementation projects under a BCC

When applying for a business registration certificate to establish a 100% foreign-owned company, investors should prepare a file of documents similar to the file applied for policy registration and send it to an agency in charge of business registration.

Setup a company 100% foreign-owned company

After receiving a certificate of investment registration, investors need to carry out procedures of Setup company 100% foreign-owned companies. Required documents include:

- Request for business registration

- Charter

- List of members or shareholders.

- Copies of the following documents:

+ ID, Passport or other legal personal identification of individual members or shareholders;

+ Decision of establishment, business registration certificate of other equivalent corporate documents and authorization letter;

+ The copies of business registration certificate or other equivalent documents must be notarized at a consular if members are foreign corporates.

- Business registration certificate as regulated by Investment Law, applicable to foreign investors.

The application for establishing a company with 100% foreign-owned capital shall be submitted at a business registration agency under the Department of Planning and Investment of the province/ city at which the company is intended to be located. Within 05 working days since as to the date of receiving full documents, the business registration agency shall consider and issue a business registration certificate.

Publicize the establishment of the company with 100% foreign-owned capital

After being granted the business registration certificate, the company is obliged to publicize its establishment on a national information portal.

Contents of the announcement include the contents of the business registration certificate and other information as followed:

- Lines of business;

- List of founding shareholders and foreign shareholders to joint stock companies.

Have the business seal made

After making the establishment of a 100% foreign-owned capital company public, the company now carries out having company seal made at one of the authorized seal making units. The company decides the number and form of the seal to the extent permitted by law.

Have the seal sample publicized on a national business registration portal

After the seal is made, the company publicizes the seal sample on a national business registration portal and receives 01 confirmation of publicized seal sample issued by the Department of Planning and Investment.

Obligation to provide information during procedures of establishing a company with 100% foreign-owned capital

During procedures of establishing a company with 100% foreign-owned capital, investors have to provide Vietnamese competent authorities with some basic information. Such information is essential to support Vietnamese authorities to verify an authentic file of establishing a company with 100% foreign-owned capital.

If investors are individuals, they need to provide the following basic information and document:

- Valid ID card, or passport;

- Confirmation of an account bank balance;

- Bank’s notice, or confirmation of transferring to capital contribution account of the corporate;

- Criminal record of the investors;

If investors are legal entities, the below information should be provided to Vietnamese competent authorities while carrying out procedures of establishing foreign-owned capital companies:

Resolution/ Decision of capital contribution of the Board of Shareholders/ Board of Members according to regulations of law and charter of foreign corporate;

Copies and translations of the foreign company’s business certificate/ decision certified at a consular

Company’s charter;

Foreign investor’s audited financial statement of the latest year;

- Credit notice (bank confirmation of transfer to the capital contribution account of the company);

Besides, investors also have to provide some more basic information about the intended business, including:

- Name of the company

- Business address of the company

- Charter capital/ Investment capital of the intended company

- Registered business lines

Obligation to prove its business location legal when registering for company establishment of 100% foreign-owned capital

Investors when registering for establishment of a company with 100% foreign-owned capital in Vietnam are obliged to prove its business location legal. They can fulfill this obligation by providing a Vietnamese competent authority with the following documents:

- A certified lease contract of headquarters (where the company is located in Vietnam);

- A certificate of land use right.

If the lease contract is made with a legal entity, such legal entity must register for real estate business on its business registration; if it is made with an individual and the term of the contract is more than 06 month, it must be certified at a notary office.

Above are the specific regulations relating to procedures of establishing a company with 100% foreign-owned capital? Foreign investors who intend to establish a company in Vietnam for business operation should carefully consider and comply with those regulations.

0 comment