How To Register A Business In Vietnam

- 05/08/2022

Doing business in Viet Nam (Step by Step Guide) → How to register a business in Vietnam conducted by investors has always been subject to quite rigorous adjustments of investment and business laws.

CONTENT

CONTENT

CONTENT

CONTENT

☆ REGISTER A BUSINESS IN VIETNAM

How to register a business in Vietnam conducted by investors has always been subject to quite rigorous adjustments of investment and business laws

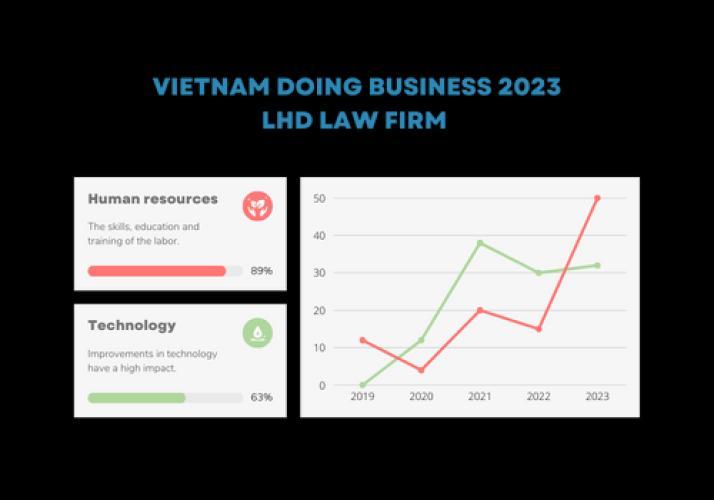

In recent years, along with the non-stop development of our country’s economy and society, the number of foreign investors investing and building business in Vietnam is more and more increased. Establishing 100% foreign-owned capital companies has become popular business. With its unique characterization, establishing a company with 100% foreign-owned capital has always subject to quite rigorous adjustment of investment and business laws.

Register investment policy prior business in Vietnam

Before carrying out setting up a 100% foreign-owned company, investors must apply for an Investment Registration Certificate at an agency of business registration. In some cases, investors must register its investment policy with a provincial People's Committee.

Required documents include

- A request for implementation of the investment project;

- A copy of ID card, passport, or certificate of business registration, or other equivalent document;

- A proposal of project investment: investors’ names, investment objectives, scale, capital and capital mobilization plan, location, duration, impact assessment, report on socio-economic efficiency, etc.

- A copy of one of the following documents: financial statement within the last two years; commitment of financial support from its parent company or a financial institution; guarantee of financial capability; documents proving capital capability;

- Demand for land use;

- Explanation on technology application, including name of such technology;

- BCC contract in case of implementation projects under a BCC

When applying for a business registration certificate to establish a 100% foreign-owned company, investors should prepare a file of documents similar to the file applied for policy registration and send it to an agency in charge of business registration.

Establish a company with 100% foreign-owned capital and register its business

After receiving a certificate of investment registration, investors need to carry out procedures of establishing a company with 100% foreign-owned capital. Required documents include

- Request for business registration

- Charter

- List of members or shareholders.

- Copies of the following documents:

- ID, Passport or other legal personal identification of individual members or shareholders;

- Decision of establishment, business registration certificate of other equivalent corporate documents and authorization letter;

- The copies of business registration certificate or other equivalent documents must be notarized at a consular if members are foreign corporates.

- Business registration certificate as regulated by Investment Law, applicable to foreign investors.

The application for establishing a company with 100% foreign-owned capital shall be submitted at a business registration agency under the Department of Planning and Investment of the province/ city at which the company is intended to be located. Within 05 working days since as to the date of receiving full documents, the business registration agency shall consider and issue a business registration certificate.

Publicize the establishment of the company with 100% foreign-owned capital

After being granted the business registration certificate, the company is obliged to publicize its establishment on a national information portal.

Contents of the announcement include the contents of the business registration certificate and other information as followed:

- Lines of business;

- List of founding shareholders and foreign shareholders to joint stock companies.

Have the business seal made

After making the establishment of a 100% foreign-owned capital company public, the company now carries out having company seal made at one of the authorized seal making units. The company decides the number and form of the seal to the extent permitted by law.

Have the seal sample publicized on a national business registration portal

After the seal is made, the company publicizes the seal sample on a national business registration portal and receives 01 confirmation of publicized seal sample issued by the Department of Planning and Investment.

Obligation to provide information during procedures of establishing a company with 100% foreign-owned capital

During procedures of establishing a company with 100% foreign-owned capital, investors have to provide Vietnamese competent authorities with some basic information. Such information is essential to support Vietnamese authorities to verify an authentic file of establishing a company with 100% foreign-owned capital.

If investors are individuals, they need to provide the following basic information and document

- Valid ID card, or passport;

- Confirmation of an account bank balance;

- Bank’s notice, or confirmation of transferring to capital contribution account of the corporate;

- Criminal record of the investors;

If investors are legal entities, the below information should be provided to Vietnamese competent authorities while carrying out procedures of establishing foreign-owned capital companies

- Resolution/ Decision of capital contribution of the Board of Shareholders/Board of Members according to regulations of law and charter of foreign corporate;

- Copies and translations of the foreign company’s business certificate/ decision certified at a consular

- Company’s charter;

- Foreign investor’s audited financial statement of the latest year;

- Credit notice (bank confirmation of transfer to the capital contribution account of the company);

Besides, investors also have to provide some more basic information about the intended business, including

- Name of the company

- Business address of the company

- Charter capital/ Investment capital of the intended company

- Registered business lines

Obligation to prove its business location legal when registering for company establishment of 100% foreign-owned capital

Investors when registering for establishment of a company with 100% foreign-owned capital in Vietnam are obliged to prove its business location legal. They can fulfill this obligation by providing a Vietnamese competent authority with the following documents:

- A certified lease contract of headquarters (where the company is located in Vietnam);

- A certificate of land use right.

If the lease contract is made with a legal entity, such legal entity must register for real estate business on its business registration; if it is made with an individual and the term of the contract is more than 06 month, it must be certified at a notary office.

Above are the specific regulations relating to procedures of establishing a company with 100% foreign-owned capital? Foreign investors who intend to establish a company in Vietnam for business operation should carefully consider and comply with those regulations.

.jpg)

Choose LLc or JSC Company in Viet Nam

|

Time for register a company in Viet Nam |

Approximately 1 to 3 months from submission of documents to the Department of Planning and Investment |

Approximately 1 to 3 months from submission of documents to the Department of Planning and Investment |

|

Suitable for |

Small to medium sized business |

Medium to large sized businesses |

|

Number of founders |

1 to 50 founders |

At least 3 founders |

|

Corporate structure |

|

|

|

Liability |

Founders’ liability is limited to the capital contributed to the Company |

Founders’ liability is limited to the capital contributed to the Company |

|

Issuance of shares and public listing |

A Vietnamese LLC cannot issue shares and be publicly listed on the local stock exchange |

A Vietnamese JSC can issue ordinary and preference shares, the shares can be listed on the public stock exchange |

☆ STEP BY STEP REGISTER A BUSINESS IN VIETNAM

Procedures for establishing a foreign-invested company from 1% to 100% capital of foreign investors are as follows.

Step 1: Prepare the application for the Investment Registration Certificate

- Apply for an Investment Registration Certificate, including:

- A written request for the implementation of an investment project.

- Documents certifying legal status:

- For institutional investors: A copy of the Certificate of Establishment or other equivalent document certifying the investor's legal status as an organization.

- For private investors: Copy of identity card / identity card or passport of the private investor.

Investment project proposal includes investor implementing the project, investment purpose, investment scale and investment capital content. Capital mobilization plan, location, time, investment progress, labor demand, investment incentives proposal, impact assessment, socio-economic efficiency of the project.

Register your business in Vietnam in the form of capital contribution right from the start

- Proof of investor's financial capacity:

- For institutional investors: Financial statements of investors for the last two years. Or promise financial support for the parent company. Or, we promise financial support from financial institutions. Or ensure the financial capacity of the investor. Or a written explanation of the investor's financial capacity.

- For individual investors: Check your account balance and passbook.

- Head office lease contract, written confirmation of the lessor's right to lease (the lessor's land use right certificate, construction permit, business registration certificate with real estate business function) or equivalent document).

- Proposing land use needs; The location proves that the investor has the right to use the site to implement the project if the project is not allocated or leased land by the State or the land use purpose is not changed. copy of the tenancy agreement or other document. Current investment projects;

- An explanation describing the use of technology in an investment project for a project using technology on the List of technologies restricted from transferring under the Law on Technology Transfer, including: machinery, equipment and technical lines main art.

Step 2: Submit application for investment registration certificate

- Issuance of Investment Registration Certificate for investment projects not subject to decision on investment policies:

- Declare information about investment projects online on the National Foreign Investment Information System

- Before carrying out the procedures for issuance of an Investment Registration Certificate, investors must declare online information about their investment projects on the National Foreign Investment Information System. Within 15 days from the date of submitting the online application, the investor must submit the investment registration dossier at the Investment Registration Authority.

- After the Investment Registration Authority receives the application, the investor will be granted an account to access the National Information System on Foreign Investment to monitor the processing of the application.

- The investment registration agency uses the National Foreign Investment Information System to receive, process and return investment registration results, update the application processing status and issue project codes.

Step 3: Issue an investment registration certificate

Within 15 days of receiving the complete application, the investment registrar shall issue an investment registration certificate. In case of refusal, the investor should be notified in writing and the reason should be clearly stated.

Step 4: Prepare the documents and submit the application for the business registration certificate

After the investment registration certificate has been granted to the foreign investment company, the investor shall carry out the procedure for granting the corporate registration certificate in the same manner as the procedure for establishing a Vietnamese company.

- Application documents for company registration certificate

- Business registration application.

- Regulations of the Company

List of members (for limited liability companies with two or more members; list of founding shareholders and shareholders who are foreign investors (list of authorized representatives if there are institutional shareholders).

Copy of the following documents: Citizen ID card, personal ID card, passport, or other legitimate personal ID of an individual member.

Establishment decisions, business registration certificates, or other equivalent documents regarding the organization and adult guardianship. Citizen ID, personal identification, passport, or other legitimate personal identification information of an official representative of a member of the organization

- For members of a foreign organization, a copy of the business registration certificate or equivalent document must be consular legalized.

- Determine capital contributions and the appointment of managers. List of approved representatives (for members of the organization);

- An investment registration certificate for investors has been granted.

Step 5: Announce the contents of the business registration information

After the company registration certificate has been granted, the company must publish it on the National Business Registration Portal. At the same time, the publication fee must be paid as required by law. The published content includes the content of the company registration certificate and the following information.

List of founding shareholders; in the case of a legal entity, a list of shareholders who are foreign investors (if any).

Client’s investment to Viet Nam

TOYOTA

WACOAL

DELOITE

DLH; SHISEIDO

FOS

DLT

YAMAZEN

SANKOUGIKEN

DIEMSANG

IFO

ALTECH

TRIUMPH

SOMETHINGHOLDINGS

JABES

SPASH INTERACTIVE

YM

CORELEV

VIET AGO

STENCIL

SHINWON

DLT

AYOBA

E&C VINA

TYCOOND

ILLHO

VIETPOLL

BIOMIN

M&R FORWARDING

WSP VN

J. DROUP

HALFEN MOMENT

MARTIME

DAIKOAD

RICOH VN

CHEMSTATION ASIA

DEVPROSOFT

ATEA

OPTIMUM GLOBAL

V STENCIL .... and More

4 comment

Lee

What is the process of setting up a business by a foreigner in Vietnam?

Neville McGann

Good morning. I want to set up my own business teaching English, as a sole trader. Can you please tell me how to register the business name and what I need to do to register as a sole trader. Can you also please let me know what you charge for initial consultancy. Thank you.

Nathan

Good Day, I would like to enquire about the fees related to registering a Foreign-Owned LLC (Trading) using your services and expertise - we have 3 partners (2 foreign + 1 local) - please advise if there is another suitable legal entity type. We are in the Fashion Supply Chain industry so the main role of the registered business in Vietnam (HCMC) would also need the appropriate licenses (trading) for: Import/Export of Fabrics and Apparels Opening of bank account In the current situation, in-person travel would not be possible so how would it be done now? Please do let me know if you need more information. Many Thanks!

Miss Guiseppe Koch

Intranet

Send comment